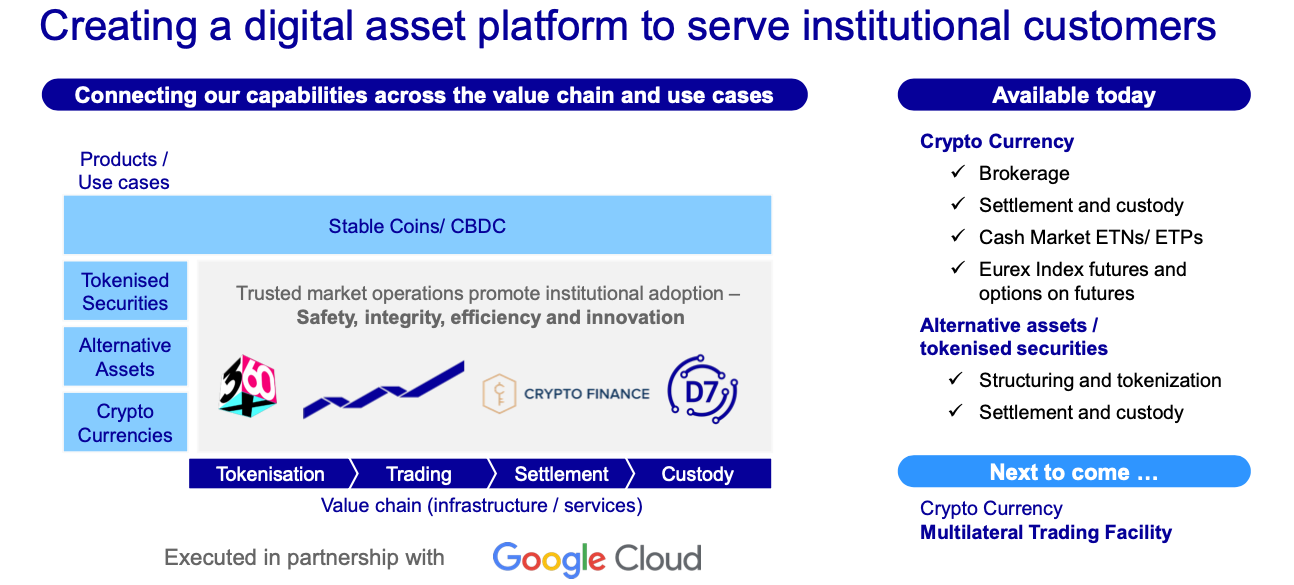

The Deutsche Börse went live with its cryptocurrency trading offering DBDX earlier this month. Now the stock exchange has revealed plans for a Digital Assets Business Platform. The company already has Clearstream’s D7, a digital securities issuance and post trade solution, and a 48% interest in 360X, the tokenization platform for alternative assets including real estate and IP.

Deutsche Börse said in its annual report that “digital assets will increase the range of investable and tradable instruments significantly. With the Digital Asset Business Platform we want to make tokenised assets fungible for institutional customers and profit from this trend over the long term.”

It continued, “We are planning to build an ecosystem for digital assets that is operated on the basis of an institutional value chain, using native digital infrastructure components in the cloud. The platform would conform to recognised standards in the finance industry and service a variety of asset classes and use cases on and off the blockchain.”

Update: after publication, a Deutsche Börse spokesperson noted that the platform was highlighted in a presentation late last year. We’re including the most relevant slide below.

Given it already has D7 for native digital securities issuance, we’d speculate this might be a more general tokenization offering. For example, it could enable the tokenization of existing securities, funds or assets. This is not dissimilar to its role in HQLAᵡ, the collateral mobility company in which it has a 30.5% stake. There it acts as a trusted third party. For tokenizing off blockchain assets, it could vouch for the existence of the underlying assets.

Meanwhile, the stock exchange’s involvement in DLT has covered a wide range of asset classes so far. It bought FundsDLT, the distribution startup, and listed numerous crypto exchange traded products (ETPs).

One of the few areas it hasn’t mentioned so far is tokenizing private company shares. We’d observe that it happens to own a 40% stake in Forge Europe, the subsidiary of the largest trading venue for unicorn stocks.

Deutsche Borse is planning on-chain cash?

The stock exchange gave an update on some of its other DLT activities. D7, the Clearstream tokenization and post trade solution has conducted same day issuance of 7,000 securities so far (mainly structured products). These are all in the centralized registry, but there are plans for a decentralized one.

Additionally, the Deutsche Börse hinted at on-chain cash. Apart from the 7,000 issuances, it said, “We want to build on this success and enable our customers to manage and settle positions and accounts digitally in future – and to do so for all their asset classes.”

Competitor Euroclear used on-chain cash for settlement last year as part of a World Bank bond DLT issuance. Hence, Clearstream Banking could do likewise. Additionally, the Deutsche Börse is taking part in wholesale DLT settlement trials with the European Central Bank (ECB).

A crypto update

It’s too soon for news on the DBDX crypto exchange, which only launched two weeks ago. However, DBDX dovetails with Crypto Finance, the Swiss crypto exchange acquired by the Deutsche Börse in 2021 for CHF 100 million. The stock exchange is writing down its interest in Crypto Finance by €24.6 million “because its performance was persistently under plan.” It also revealed that it had €7.9 million of crypto on its year-end balance sheet, likely linked to Crypto Finance.

Update: added the slide from last year’s presentation.