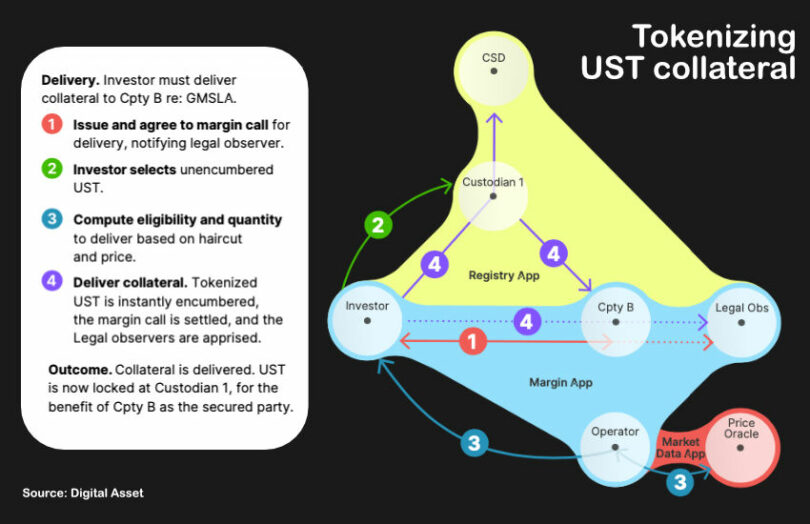

During June and July, Digital Asset and the DTCC conducted a pilot with several other market participants to tokenize Treasuries for use as collateral. One of the key advantages of blockchain is the ability to support intraday transactions, which makes tokenized Treasuries the perfect collateral for margin calls.

While there are $2 billion in tokenized Treasuries on permissionless blockchains, by contrast these trials involved the public permissioned Canton Network connected to the DTCC’s LedgerScan.

A key challenge is most collateral takes time to transfer, whereas using blockchain it can be instant and 24/7, hence the intraday applications.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.