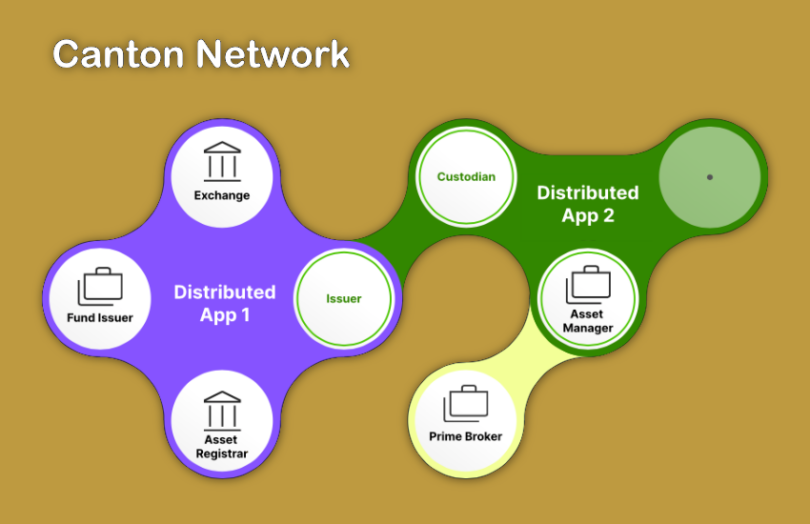

Earlier this year Digital Asset revealed that 45 institutions had participated in a DLT interoperability trial of the Canton Network since August last year. To date institutions have built siloed DLT networks, which desperately need to be linked in order for tokenization to achieve its potential. Today Digital Asset launched the ‘Global Synchronizer’, the decentralized infrastructure that enables the Canton Network. It includes the Global Synchronizer Foundation to govern the project, 32 participants, plus a utility coin for the public permissioned network.

Several big names are involved in the launch. They include Broadridge, Calastone, Cumberland DRW, Equilend, SBI Digital Assets, Tradeweb and Standard Chartered’s Zodia Custody. The 32 participants have a variety of roles, including as super validators, node operators, governance members and organizations running applications on the network. Some of the big banks and stock exchanges involved in previous network tests aren’t among the first wave of participants.

Stepping back, numerous initiatives are exploring how to address interoperability for tokenization in regulated financial markets. They include the Unified Ledger concept, Singapore’s Global Layer One (GL1), the Regulated Liability Network and its U.S. cousin, the Regulated Settlement Network. In each case, one primary technology is likely to be used. The Global Synchronizer likewise can offer a single network where applications can be deployed using Digital Asset’s technology.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.