While the future is unpredictable, one where digital currencies dominate both money and payments seems a reasonable possibility. The benefits of convenience, lower cost and the possibility of greater financial inclusion seem irresistible. However, An area that hasn’t attracted sufficient attention is the potential increased fragility of money. And this has nothing to do with volatile cryptocurrency valuations. While flaws with various kinds of stablecoin designs have been previously highlighted, the fragility issue goes beyond these and could impact central bank digital currencies (CBDC) as well.

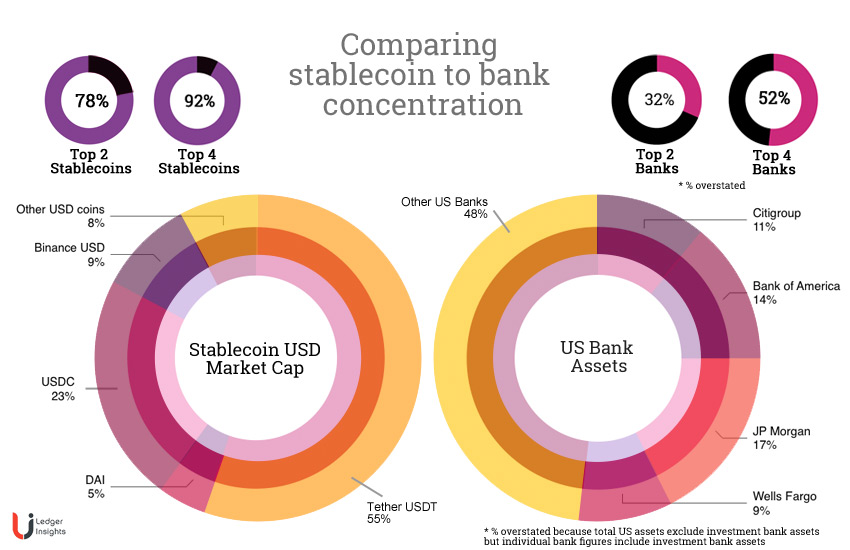

Today, money is reasonably decentralized, with most money creation spread over many commercial banks. Despite the decentralization of blockchain, in a digital currency future, there will be a far smaller number of CBDCs and stablecoins. The issue of being too-big-to-fail will become an even greater one.

A second reason for fragility is that money balances and payment infrastructures are separated in most current systems, making the ecosystem more robust. That makes them more resilient to previously undiscovered cryptographic flaws or software bugs. Tokenized digital currency systems combine the payment message and the money. That critical benefit is also a weakness, a potentially fatal one.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.