Highlights

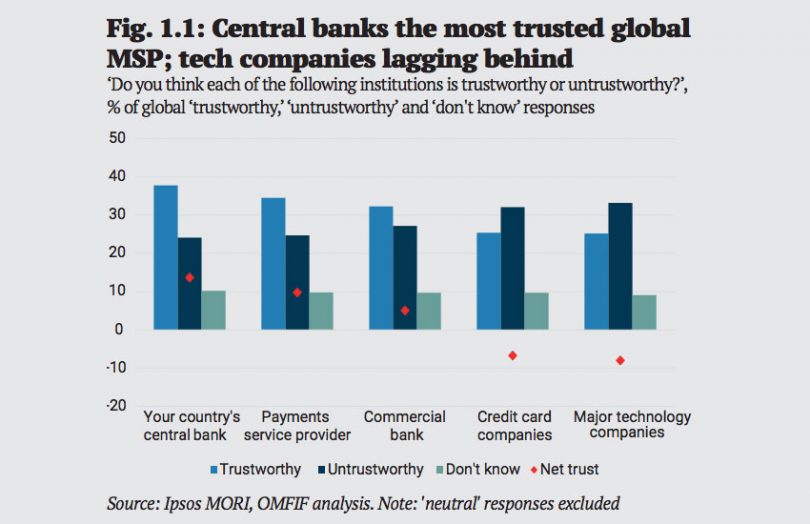

- Central banks most trusted, followed by payments firms

- Tech companies viewed with distrust, but not in emerging markets

- Emerging markets more open to digital currencies, developed world not so much

- Lower income have less trust in all methods of payment

- Security is the most desired payment characteristic, but least rated feature of digital currencies

A new Ipsos MORI / OMFIF survey into consumer attitudes towards money has found that central banks are the most trusted institutions.

It’s widely known that digital currencies are favored by well off younger men. But these demographic differences are small compared to nationality. The only thing people agree on worldwide is a strong preference for safety as a feature of money compared to convenience.

Generally, emerging-market citizens are much more trusting of all institutions that might issue digital currencies. That applies to tech companies who are heavily distrusted in developed economies. And in emerging markets, people have much more favorable attitudes to digital currencies of any type.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.