Today dGen, a non-profit think tank focused on emerging technology, published a paper exploring central bank digital currencies (CBDC). In particular, it looks at a potential digital Euro and the geopolitical ramifications of CBDC.

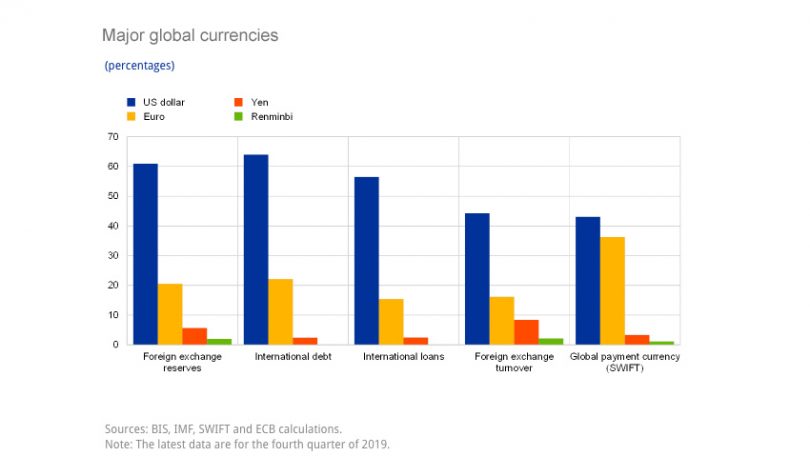

It predicts that a digital yuan will not unseat the U.S. Dollar but represents a major challenge to the world’s number two reserve currency, the Euro. In fact, dGen says that Europe needs a CBDC by 2025 to stop this happening.

It quotes Philipp Sandner of the Frankfurt School Blockchain Center: “[The] ECB’s reaction has been too slow. Especially, the benefits from a CBDC for the industry, e.g., based on programmable money, are currently neglected. Given Libra and the [Chinese] DC/EP, the ECB has to react quickly to keep its geopolitical position”.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.