Cryptocurrency has shown it’s possible to have 24/7 borderless trading. However, translating that to digital securities runs up against regulatory differences across jurisdictions. In November, UBS unveiled live transactions with Singapore’s DBS Bank and Japan’s SBI, showcasing how supportive regulations can help. We spoke to Winston Quek, CEO of Singapore’s SBI Digital Markets (SBI DM), about the potential for cross border digital securities and tokenization.

The November transactions were part of Singapore’s Project Guardian and showcased a digital yen and a native digital securities issuance. Both formed part of a repo transaction executed on the Ethereum public blockchain.

Of course, cross border securities trading happens today. But there are considerable costs and frictions because of the need to involve multiple central securities depositories (CSDs) in several jurisdictions.

With these native digital securities, the blockchain and smart contracts fulfill many tasks usually done by a CSD. Mr Quek noted by cutting out the CSD layer, you gain the efficiencies of transferring a token directly into a client wallet.

Hence, one layer of efficiency is gleaned from regulations allowing the use of blockchains as the repository. Allowing the seamless movement of digital securities across borders is another. That’s what the one off Project Guardian transactions demonstrated.

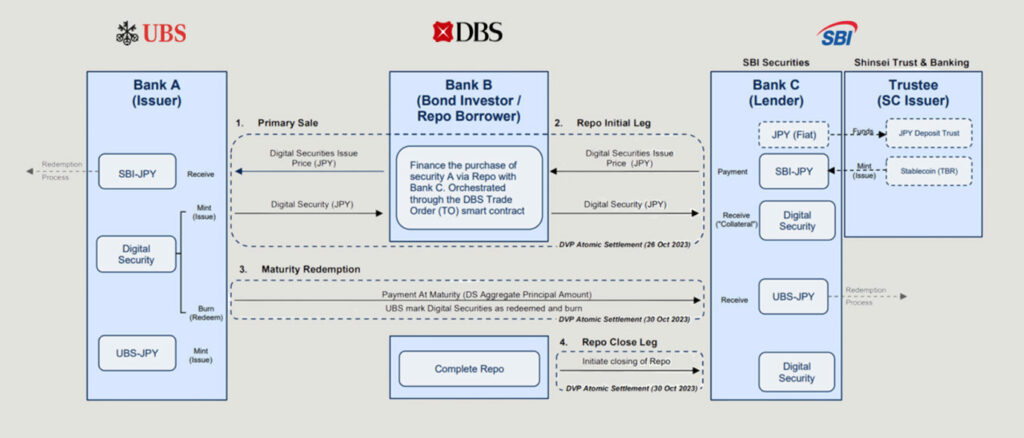

The Project Guardian repo transaction

UBS issued a native Yen denominated bond in Switzerland and sold it to DBS in Singapore. DBS then sent the bond as collateral for a repo transaction to SBI Securities in Japan. SBI Shinsei Bank minted a Japanese Yen token, which SBI Securities used to pay DBS the cash end of the repo transaction. When the repo matured, all the legs of the transactions were unwound, including burning (redeeming) the digital security. SBI Digital Asset Holdings (SBI DM’s parent) coordinated the SBI group’s involvement.

The transaction involved three regulators – Switzerland’s FINMA, the Monetary Authority of Singapore (MAS), which hosts Project Guardian, and Japan’s FSA. Both Swiss and Singapore legislation support native securities issued on public blockchains. Japan also supports native digital securities without using a CSD, but to date they’ve been issued on permissioned platforms such as Progmat and BOOSTRY‘s iBet for Fin. Mr Quek mentioned that Japan’s FSA gave permission for the one off transaction and observed the transactions.

Regular readers will have guessed that the biggest chunk of work was the legal side, which took as much as nine months. The transaction involved a hybrid of Swiss DLT law and English common law.

Stepping back, while these three jurisdictions are amongst the most progressive for tokenization, other major markets are leaning in. Germany was also early to pass legislation and there has been a reasonable volume of token issuances. Meanwhile, the EU’s DLT Pilot Regime supports both allowing blockchain to be the primary securities registry and the use of public blockchain. The UK’s Digital Securities Sandbox, which starts in January, also allows the blockchain as the registry but initially requires permissioned blockchains.

Tokenization has different benefits for each party

Beyond the Project Guardian use case, Mr. Quek shared his views on tokenization. He noted that currently much of the impetus is coming from the sell side. And he’s not wrong.

There’s an ever growing list of bulge bracket banks with their own digital asset platforms. We’ve already touched on four so far – UBS Tokenize, DBS, Progmat and BOOSTRY. There’s also Goldman’s, JP Morgan’s, HSBC’s, SocGen’s, BNP Paribas’, Credit Agricole’s and more. That list of 10 platforms is without checking our database where there are plenty more.

Mr Quek’s point is it takes more than the sell side to make a market.

“If you think about it – a bank, a security house, a family office, the buy side, the sell side, the intermediaries – the process of tokenization is not similar. Everybody does it for their own specific reasons,” said Quek.

“For a bank, it’s capital usage, efficiencies. For the investor, they don’t really care if you get it (settlement) in T+0 or T+1 or T+2. But they care about getting access to private equity, to certain deals, to certain illiquid products that are otherwise not mainstream.”

He also noted that the bulge bracket banks have a lot to gain because just a few basis points spread over a large transaction volume yields big profits.

“When we get a client in front of us, the first question is, why do you want to tokenize?” said Quek. SBI Digital Markets’ focus is on what use cases are scalable and practical. One area that stands out is real estate, where its Japanese sister firm has some experience and SBI DM has client mandates to explore. The other area is private equity.

Don’t oversell fractionalization

At a practical level, Mr Quek sees the efficiencies enabled by blockchain as empowering fractionalization. However, he was cautious that this benefit is sometimes oversold.

SBI DM’s interest in private equity “is not because through fractionalization we can create liquidity. I’m quite skeptical of that statement,” he said. “A lot of times we don’t see that actually happening.”

“We’d like to be able to bring private deals and maybe certain families don’t really want to lay out a few million dollars. They want to participate. They want to have involvement, not because it’s tokenized, but because they like the asset class.” Hence, with smaller transaction sizes they can get exposure more easily. Typically, institutional deals might require a commitment of $5 million and a long term lockup of funds. High net worth individuals might be more comfortable with something in the $500,000 range.

Fixed income and structured products

Real estate and private equity show the benefits of fractionalization. But at a practical level, Mr Quek noted that fixed income gleans significant efficiencies from blockchain. That’s particularly the operational efficiencies which can be a big deal for low margin commoditized offerings such as structured products. We’d note that during this quarter the Deutsche Börse Clearstream’s (centralized) digital securities platform D7 grew from a hundred products to thousands in weeks, because of structured products and automation. Despite being centralized it uses blockchain and smart contracts.

However, the two areas where SBI Digital Markets has client mandates in 2024 are private equity and real estate.

But like many others in this sector, Mr Quek was keen to manage expectations about tokenization.

“There’s no doubt that SBI is a believer. This transformation is not going to happen in two, three years, five years,” said Mr Quek. “It is a decade in the making. It’s a paradigm shift.”