A report from the European Central Bank (ECB) concludes that crypto-asset markets are not yet sufficiently large or interconnected with traditional finance to pose financial stability risks. However, it warns that if the current growth trajectory and market integration continue, the sector will pose a risk.

A Fidelity survey showed that 56% of European institutional investors have some exposure to crypto-assets, up from 45% in 2020. The central bank puts that down to new services making crypto more accessible such as crypto derivatives and ETFs. Additionally, it points to German legislation allowing institutional funds to put up to 20% of assets into crypto-assets.

Several international banks, including those in the Euro area, are trading and clearing regulated crypto derivatives, although the activity is on behalf of clients. More are considering offering custody services when the EU’s crypto regulations, MiCA come into force.

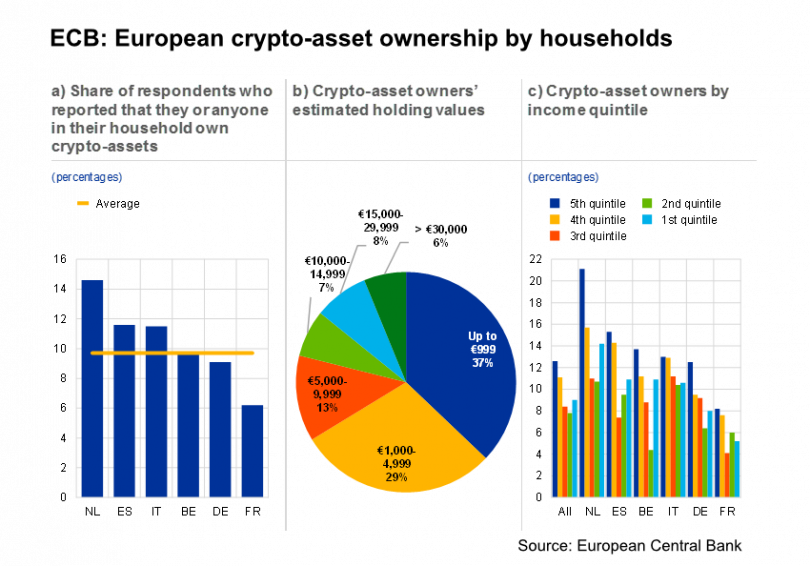

A domestic survey conducted by the ECB found that up to 10% of households hold cryptocurrencies, although most hold less than €5,000 ($5,350). One in fifteen of the crypto-investing group holds more than €30,000. The income groups most likely to invest are the wealthiest, followed by the poorest. In other words, middle-income groups are least likely to have exposure.

The central bank highlighted several risks to consumers, including:

- misleading information

- lack of recourse

- product complexity and leverage

- fraud and money laundering

- market manipulation.

While MiCA will address many of these issues, the central bank highlighted that it will only come into force in 2024 at the earliest, despite the urgency.

With this rising level of institutional and consumer exposure, the riskiness of the crypto markets is also increasing. That’s partly because of high levels of leverage and the rapidly expanding crypto lending markets, which grew by a factor of 14 times in 2021. The report highlights actions taken by the U.S. SEC against BlockFi and Coinbase shelving a planned crypto lending product. And it warns, “DeFi platforms that mimic traditional financial services would do well to ensure they comply with existing EU financial regulation.”

The high concentration in liquidity provision makes the sector prone to runs.

The ECB is particularly concerned because it believes it doesn’t have the tools to assess the financial stability risks. It has inadequate data to judge the interconnections, and much of the activity happens outside the regulatory perimeter. “Most publications from crypto-asset service providers (including platforms, exchanges and data aggregators) are not verifiable and should be treated with caution,” says the ECB.