The European Central Bank (ECB) provided a status report on its central bank digital currency (CBDC) work. Key digital euro decisions so far include:

- most payments will be validated via third parties. In other words, intermediated

- the digital euro will both have holding limits and be interest-bearing

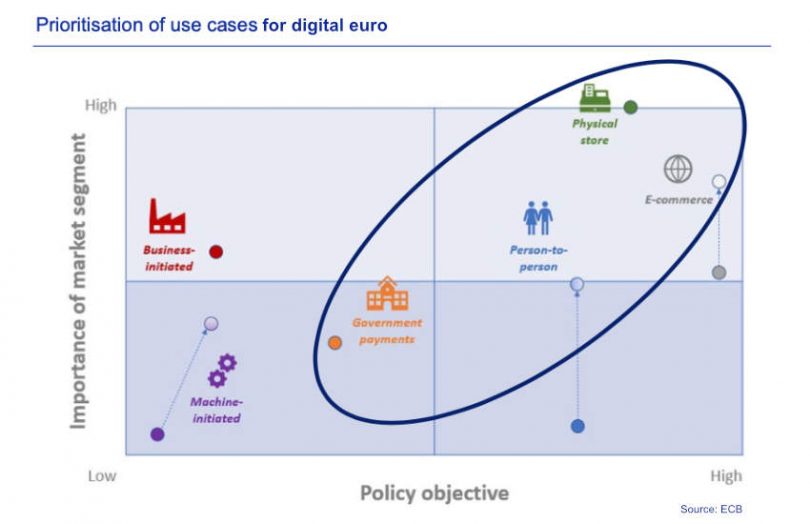

- the prioritization of use cases around physical store and ecommerce payments.

Today ECB board member Fabio Panetta also set out a plan for a digital euro scheme involving a set of rules, practices and standards with plans to start working on a rulebook.

Regarding the digital euro transfer mechanism, most payments will be executed online with third party validation by intermediaries or payment firms. Where payments are offline, there will be peer-to-peer validation. However, offline payments will only be allowed for low value, low risk, close proximity transactions. Peer-to-peer validation of online transactions has been dismissed as too experimental.

It was previously reported that the ECB planned to have digital euro holding limits to prevent too large a movement of bank deposits into the CBDC. When those limits are reached, any excess balance will be swept into a bank account. Today it confirmed there would also be remuneration or interest. That’s likely because of a shift back into higher interest rate times, and a lack of interest payments could make a digital euro unattractive.

In terms of use cases, the priority is physical stores payments, followed by ecommerce and person to person payments.

The paper reiterated the ECBs long standing stance that full anonymity is not being considered. For low value, low risk transactions, the intermediary will only be able to see limited details, but there will be identity checks when a consumer is onboarded to a digital wallet.

No decision has been made regarding technology, and distributed ledger technology (DLT) is still on the table. Panetta stated that for the decision, “we will consider efficiency, safety and integration with customer-facing services, as well as the environmental impact.”

The next set of work covers decisions on the settlement model, the distribution model, the role of intermediaries including their compensation, and funding / defunding.

As previously reported, legislation for a potential digital euro will be tabled next year. And there are moves also to explore a wholesale digital euro.