The European Central Bank (ECB) announced the participants in the market contact group for Project Pontes, which will start work this month. The initiative will enable DLT capital market transactions to settle using central bank money, with plans to launch pilots in late 2026. Pontes is an interim solution, with the longer term Project Appia pursuing a more integrated approach, either involving a unified ledger or a few interoperable networks.

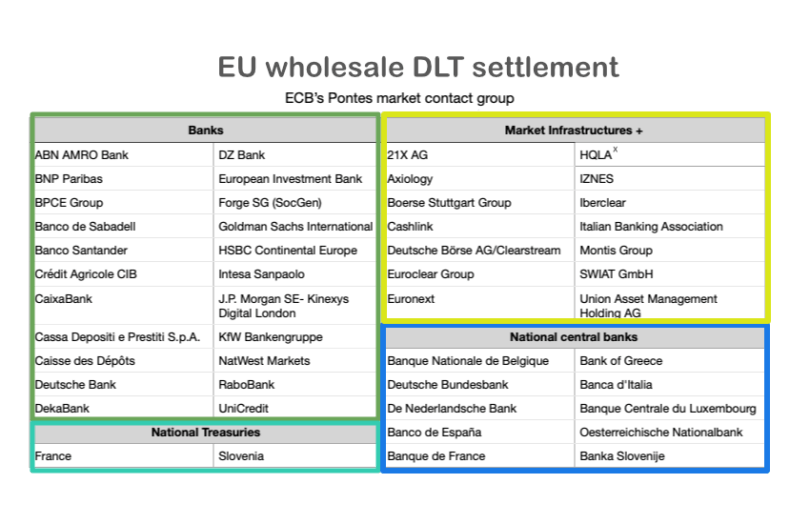

Apart from the ECB, ten central banks are involved in the market contact group alongside two national Treasury departments (France and Slovenia). Banks make up 22 of the 36 other market participants, with the remainder mainly market infrastructure providers. An ECB executive previously described Pontes as a “bring-your-own-market-DLT” approach.

Pontes is an evolution of last year’s Eurosystem DLT settlement trials which had 61 participants. The previous tests involved three solutions, one from each of the central banks of France, Germany and Italy. The initial Pontes plan was to rationalize that to two solutions, France’s wholesale CBDC and Germany’s Trigger solution, both of which link to the TARGET2 wholesale payment system. Italy’s Hashlink technology will provide blockchain interoperability, but will not provide a standalone solution. However, the list of participants implies that plans could be changing.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.