The European Central Bank (ECB) dedicated its latest Macroprudential Bulletin to crypto-assets. It published research in three areas: stablecoins, climate risks and DeFi. This article makes no attempt to summarise the works. Instead, it includes highlights.

The bulletin covers the concerns about risks and regulatory approaches, including the EU’s MiCA legislation. Given these have been covered by Ledger Insights many times, we haven’t included them here.

Stablecoins:

- Average quarterly trading volumes of €2.96 trillion is almost on a par with New York Stock Exchange (€3.12 trillion) equities volumes.

- Tether accounted for around 65% of all trading on crypto-asset trading platforms in March 2022.

- Stablecoins provide around 45% of the liquidity in decentralised exchanges (DEXes) in May 2022.

- Tether’s minimum redemption figure is $100,000.

- The ECB considers the Maker DAI as an algorithmic stablecoin (It’s backed by crypto-assets rather than fiat currency).

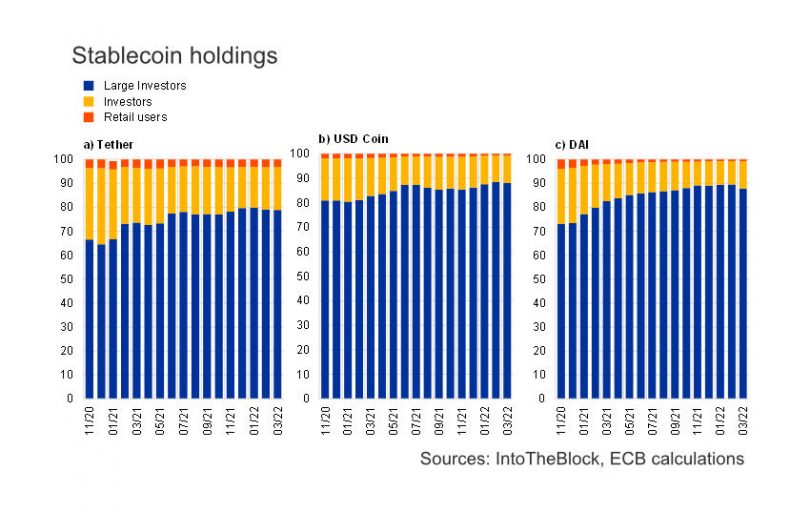

- The vast majority of stablecoins are held by whales, but less so for Tether.

Crypto climate risks:

- Bitcoin and Ethereum combined yearly emissions as of May 2022 negate past and target greenhouse gas (GHG) emission savings for most euro countries (individually).

- Sweden needs the renewable energy targeted by crypto-asset producers to address its Paris agreement targets. It’s called on the EU to ban Proof of Work mining.

- The Vice Chair of EU securities regulator ESMA has also called for a ban.

- By Jan 2025, the EU Commission has to submit an EU taxonomy for sustainable activities crypto-asset mining activities.

- “It is unlikely that bitcoin investors have currently priced in the negative ecological externalities and authorities’ possible policy measures,” states the bulleting. It cites bans on crypto mining by China and New York.

DeFi:

- 1% of wallets control 97% of DeFi governance tokens.

- Holders of governance tokens, decentralised autonomous organisation and platform developers could be brought into the regulatory perimeter.

- DeFi may require embedded regulation.

Image Copyright: European Central Bank