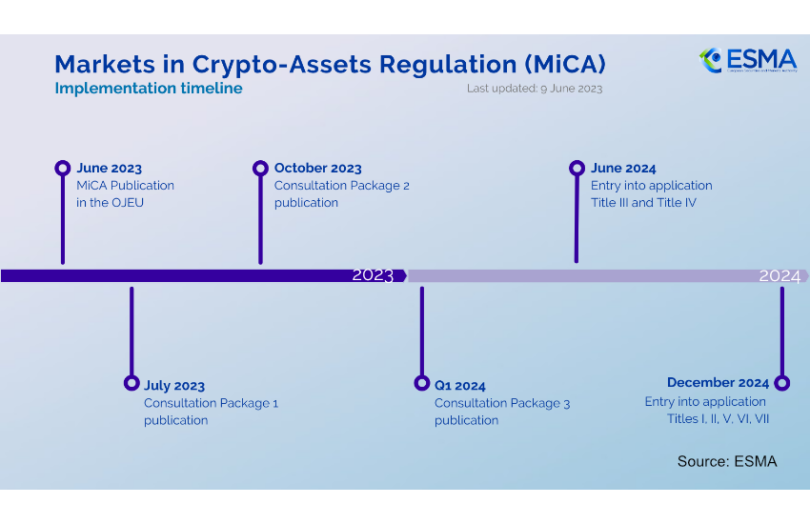

With the final publication of the Markets in Crypto-Assets (MiCA) regulation on Friday, the dates for it coming into force are now clear. Several regulators are involved, but the European Securities and Markets Authority (ESMA) has most of the responsibilities. Today it published a timeline confirming its plans for three consultations, with the first starting next month.

MiCA has two sections related to stablecoins – e-money tokens and asset-referenced tokens. These are the first regulations to come into force in June 2024, with the rest to follow in December 2024.

The content of the three consultations has not been confirmed, but the first will include authorization, governance, conflicts of interest, and complaint handling procedures.

ESMA crypto guidelines

The reason for the consultations is that ESMA is responsible for developing regulatory technical standards and guidelines for various areas. This is often in consultation with the European Banking Authority (EBA), which oversees significant e-money token and asset-referenced token platforms.

Some of the guidelines ESMA has to draw up are not straightforward. For example, it has to develop criteria to decide when a crypto-asset should be considered a financial instrument under MiFID regulation versus MiCA.

When regulators debated MiCA, there was a push to ban Bitcoin for environmental reasons. While that was cut, there’s a requirement for sustainability disclosures, and ESMA is responsible for creating the methodology.

It also has to draw up more mundane aspects such as details relating to token issuances, particularly guidelines around ensuring issuer communications are not misleading and avoiding conflicts of interest, as well as the presentation standards for whitepapers.