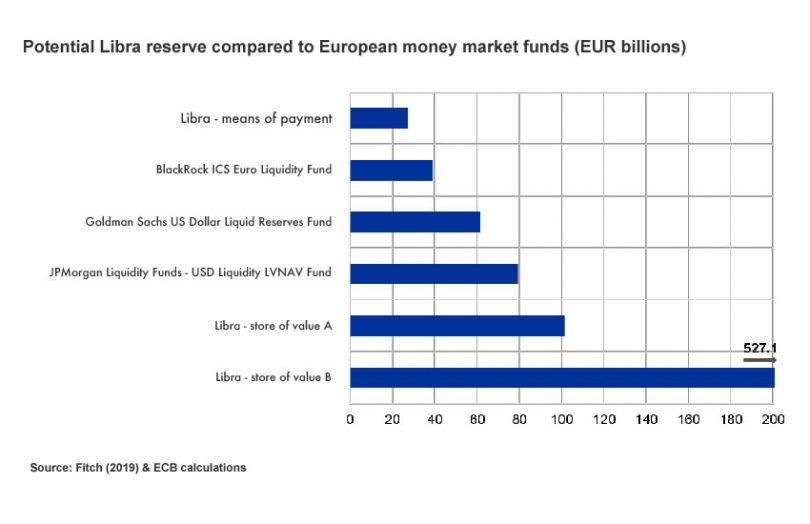

Yesterday the European Central Bank (ECB) published a paper about global stablecoins such as Libra. The emphasis was on what regulations might be relevant to the digital currency, depending on the stablecoin structure, and it particularly explores the asset management function. It further estimates the potential size of Libra’s assets depending on whether it is used purely for payments or also as a store of value.

A stablecoin usually has three aspects, the payment mechanism, the assets that back the digital currency, and the user interface or wallet. From the ECB’s perspective, payments and wallets are comparable to traditional payments systems, schemes or instruments and hence are easier to classify from a regulatory perspective.

How a stablecoin is designed and manages assets will determine its regulatory status. If token holders are guaranteed to be able to redeem coins at par, and the issuer grants no credit, it falls under EU e-money legislation. But if the issuer gives loans, then the credit provider will need a banking license.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.