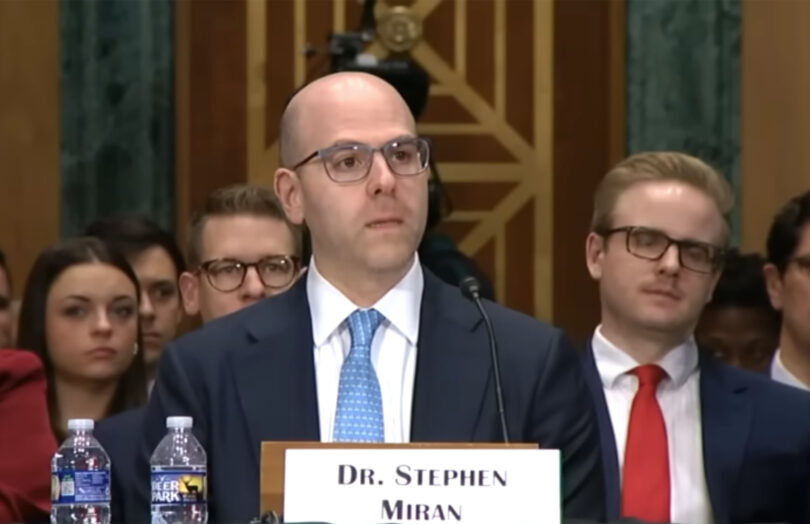

During a speech last week, the new Federal Reserve Governor Stephen Miran explored the effect of stablecoin demand on monetary policy and interest rates. Governor Miran, who is on leave as the White House Chair of the Council of Economic Advisers, sees most demand coming from emerging markets. He made an intriguing reference to fixed exchange rates, explored later in this analysis.

He doesn’t envisage significant mainstream stablecoin demand domestically or from more advanced economies. That’s because under the GENIUS Act stablecoins don’t offer yield (although it remains to be seen whether third parties can pay rewards). By contrast, it’s possible to access Treasury yields relatively easily if you live in the US or an advanced economy. In this scenario there’s likely to be limited impact on bank deposits, but the increased demand for Treasuries will drive down rates. BIS research reinforces this, estimating a 25 basis point impact. Governor Miran quoted other research indicating 40 basis points.

Regarding the scale of the impact, he mentioned industry estimates of stablecoin issuance of between $1 trillion and $3 trillion by 2030, noting the Federal Reserve’s COVID-19 quantitative easing resulted in an increase of $3 trillion in Treasury holdings.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.