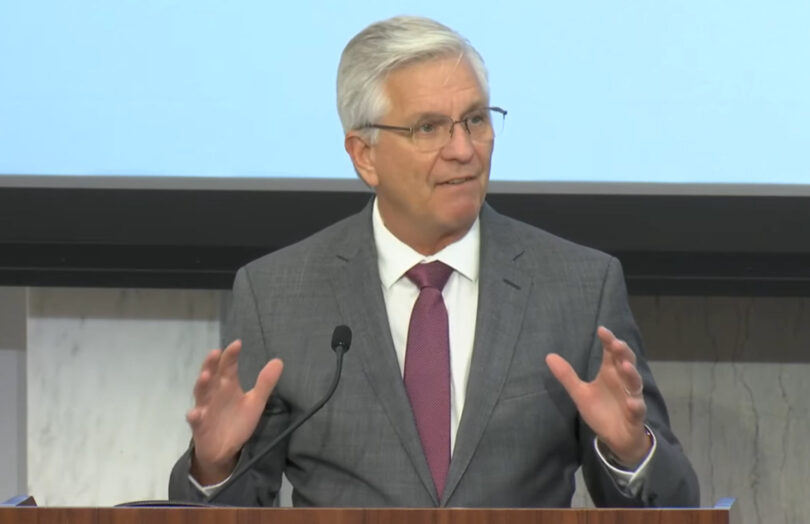

During a speech yesterday, Federal Reserve Governor Waller said he has asked the Federal Reserve to explore a pared-down master account – an account held by an institution directly with the Federal Reserve. These payment accounts are targeted at companies that currently conduct significant payment volumes via third party banks. The intention is for low risk payment providers to have an expedited approval process. As he put it, “Payments innovation moves fast, and the Federal Reserve needs to keep up.”

Governor Waller also described the accounts as “skinny” master accounts because the features are far narrower than conventional accounts. There would be no ability to borrow from the Fed, which may limit access to payment services that potentially require funding. Balances would not earn interest and there could be a cap on those balances. The Governor emphasized that this is currently just a prototype of an idea.

Notably, other jurisdictions have also allowed payment providers similar access in recent years. The Bank of England was among the first, launching RTGS.next in 2019. In January this year, the European Central Bank announced similar accounts for non bank payment service providers, with the new regime starting this month. Like the Federal Reserve’s proposals, balances are restricted to support payment volumes rather than to serve as a store of value. As previously reported, this means stablecoin issuers can only really use the accounts for on and off-ramping, rather than for reserves.

Back at the Fed’s Payment Innovation Conference where Waller made his announcement, executives from stablecoin issuers Circle and Paxos shared their views on a subsequent panel.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.