Yesterday U.S. Federal Reserve Chair Jerome Powell said of the digital dollar, “This is going to be an important year. This is going to be the year in which we engage with the public pretty actively.” He was responding to a question from Republican Representative Patrick McHenry during a congressional hearing of the House Committee on Financial Services. The Federal Reserve published a paper exploring preconditions for a retail central bank digital currency (CBDC) the same day.

Powell noted that there are tradeoffs in terms of policy and technical issues. “There are very challenging questions, so we want to have a public dialogue about that,” said Powell. In the meantime, the Federal Reserve is exploring technical challenges and collaborating with other central banks.

McHenry said, “I think the project’s vital. I think it’s vital for American competitiveness. But also there’s a fear that some want to use the digital dollar as a way to kill private sector innovation and our banking system.”

The Federal Reserve Chair responded that the U.S. had strong banks and capital markets and is keen to preserve that. “We need to be careful with our design of the digital dollar that we don’t create something that will undermine that very healthy market-based function,” said Powell.

Preconditions for a digital dollar CBDC

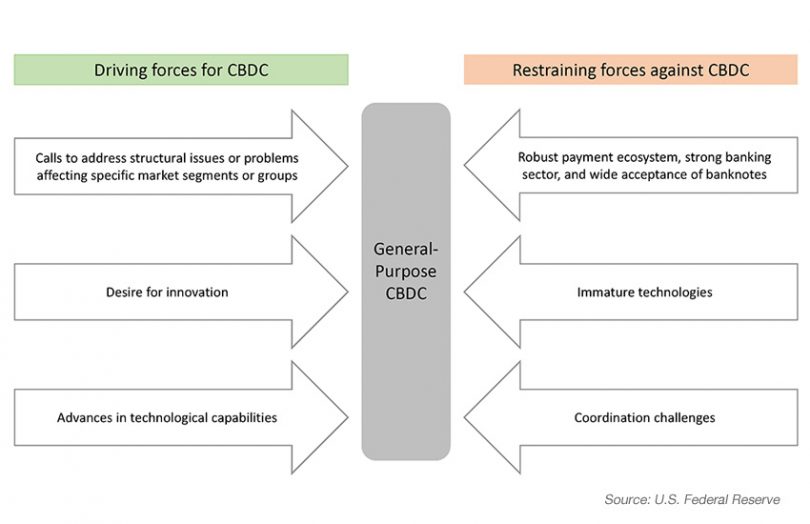

Meanwhile, the Federal Reserves note on the digital dollar outlined what is needed for a CBDC to progress. First and foremost are clear policy objectives. It noted some countries are more focused on immediate challenges, while others have more of an emphasis on future capabilities. Its map classed the digital yuan as a solution to ‘present day challenges’ whereas the U.S. is more focused on the future.

Other preconditions include broad stakeholder support as well as a strong legal framework. Many countries require laws to be changed to enable a digital currency to be treated as legal tender.

But in the U.S., legal tender means something different compared to most countries. Federal law does not compel a private business to accept a currency or coin even if it is legal tender. Our observation is that could make the rollout of a CBDC both easier and harder. Easier because not every business has to support it technically. Harder, because many businesses could opt out, and payment systems are built on network effects.

The need for robust technology is another precondition, with the Fed noting that distributed ledger technologies (DLT) would “require further advances” to operate at the scale required. The same “further advances” might be required of digital wallets to meet operational standards. And there’s the need for secure hardware to enable a digital dollar to work offline.

The final precondition is the need for market readiness which is a matter of timing. Because someone says they are interested in a CBDC doesn’t necessarily mean they will use it. And the paper points to the low level of contactless payment adoption in the U.S.

It’s not just consumers that need to adopt a CBDC, but also businesses. One of the risks is if the digital dollar is successful more outlets might refuse cash which is bad for financial inclusion.

Market readiness is not just a matter of demand but also supply. That includes a new payment rail or upgrading existing ones. And on the retail side introducing new point-of-sale technologies. The Fed notes that contactless payments and Q.R. code payments are not yet universal in the United States.

The paper concludes with a recent statement from Powell, “[T]here is a great deal of work yet to be done.”