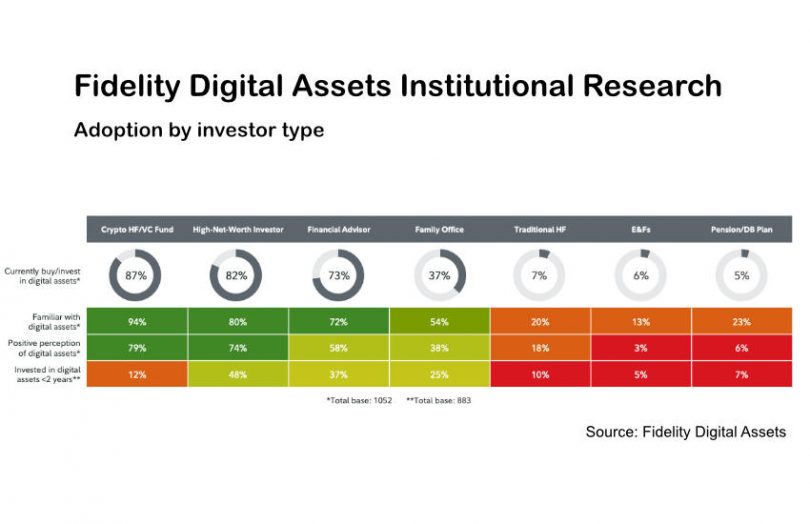

Today Fidelity Digital Assets published its institutional investor digital assets study. While it shows significant increases in adoption, there are significant differences between the types of institutions. For example, high proportions of financial advisors (73%), high net worth investors (82%) and crypto hedge funds or VCs (87%) have invested in digital assets.

In contrast, traditional hedge funds (7%), Endowments (6%) and Pension plans (5%) still show limited adoption. A far higher proportion plan to invest in the future, ranging from 29% to 38% for the three low adoption groups.

Almost two-thirds of the survey respondents were in the three high adoption investor types. Research was conducted between January and June of this year, which spanned the market decline.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.