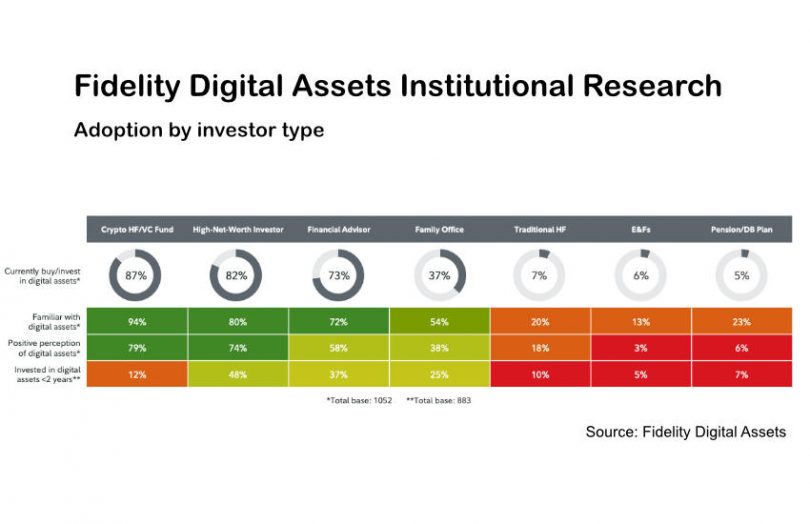

Today Fidelity Digital Assets published its institutional investor digital assets study. While it shows significant increases in adoption, there are significant differences between the types of institutions. For example, high proportions of financial advisors (73%), high net worth investors (82%) and crypto hedge funds or VCs (87%) have invested in digital assets.

In contrast, traditional hedge funds (7%), Endowments (6%) and Pension plans (5%) still show limited adoption. A far higher proportion plan to invest in the future, ranging from 29% to 38% for the three low adoption groups.

Almost two-thirds of the survey respondents were in the three high adoption investor types. Research was conducted between January and June of this year, which spanned the market decline.

Overall positive perceptions of digital assets are up to 57% from 49%. US participants increased the most reaching 39% (2021: 29%), with a small decline in Asia to 63% (2021: 60%).

There was a slight shuffling of motivations because the belief that crypto is uncorrelated to other assets is no longer widely believed. That dropped from the third spot to the fifth spot as a catalyst. The top reasons for investing in digital assets are the potential upside, as an innovative tech play, decentralization and freedom from government intervention.

The top three obstacles to investing were volatility (50%), lack of fundamentals for valuation (37%), and concerns by institutions around security (35%). Client security concerns were measured separately (33%). In all cases, the concerns were significantly greater in the United States, followed by Europe and tAsia.

Meanwhile, Bank of America recently published a survey on wealthy Americans, which showed a dramatic shift in preference away from stocks by those aged 42 or less.