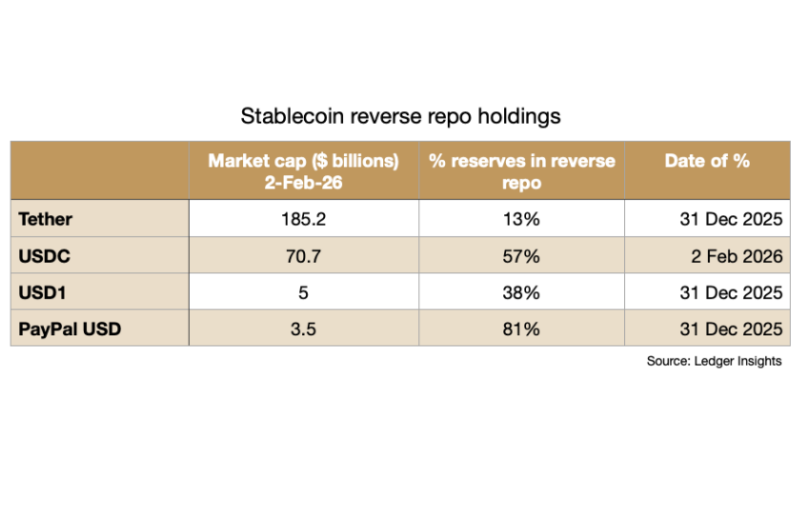

Today the Financial Stability Board (FSB) published a warning about risks and challenges to the global financial system as a result of features in the repo (repurchase agreement) markets. These concerns are particularly relevant to the stablecoin sector, where repo now makes up 54% of the reserves of the second largest stablecoin USDC, contrasting with 13% for the largest, Tether. However, Tether’s position may be riskier.

In reverse repo transactions, stablecoin issuers lend cash and receive collateral as security, usually short term government bills. One of the key FSB concerns is the expanding role of hedge funds in the sector, with hedge funds often using borrowed cash to take positions in futures markets. Additionally, hedge funds frequently receive 0% haircuts, meaning they can borrow the full value of the collateral. For the cash lender, potentially a stablecoin issuer or money market fund, this means bearing the full market risk: if asset prices drop 2% and the counterparty defaults simultaneously, the lender faces that 2% loss when liquidating collateral. However, this drop in value is less likely for short term Treasuries, especially as they can be held to maturity to receive par. The FSB is particularly concerned about knock on effects on government bond markets, with government securities used for 80% of repo transactions.

Repos have significant risk protecting features, starting with collateral held at third party custodians like BNY. Should the counterparty fail, repo transactions are supported by special 1984 legal exemptions allowing immediate collateral liquidation, unlike most recent financial contracts which can be unwound in bankruptcy proceedings. Settlement mechanics have also improved since 2008. Tri-party repos now settle at 3:30 PM rather than early morning, reducing the window where cash sits as unprotected bank deposits.

However, these operational protections don’t address a critical behavioral risk in crisis scenarios. Most repo transactions roll over on a daily basis. In a crisis when Treasury bills become desirable as the safest assets, counterparties may simply refuse to roll repos, preferring to hold their Treasury collateral rather than using it to borrow cash. This would leave the stablecoin issuer with very large sums of cash at a small number of banks during the worst possible time. Given BNY is a central player in the repo market as the main tri-party agent, much of the cash will be with BNY for a period. However, in the unlikely event that anything should happen to BNY, the government would likely bail it out given its central role to the financial system. Concentration in intermediaries and counterparties were among the concerns raised by the FSB.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.