Today The Financial Stability (FSB) published a report on Decentralized Finance (DeFi). It says that DeFi replicates traditional finance (TradFi), but it amplifies the risks. Given the FSB’s remit, its concerns include two stability areas in particular. One is the increasing linkages between TradFi and DeFi. And the second is the potential for a stablecoin failure to disrupt money markets if the reserve assets have to be liquidated quickly.

On the point of the TradFi and DeFi linkages, the report states, “the FSB will explore the growth of tokenisation of real assets as it could increase linkages between crypto-asset markets/DeFi, TradFi and the real economy.” One example is this week’s issuance of Siemens’ €60m bond on a public blockchain.

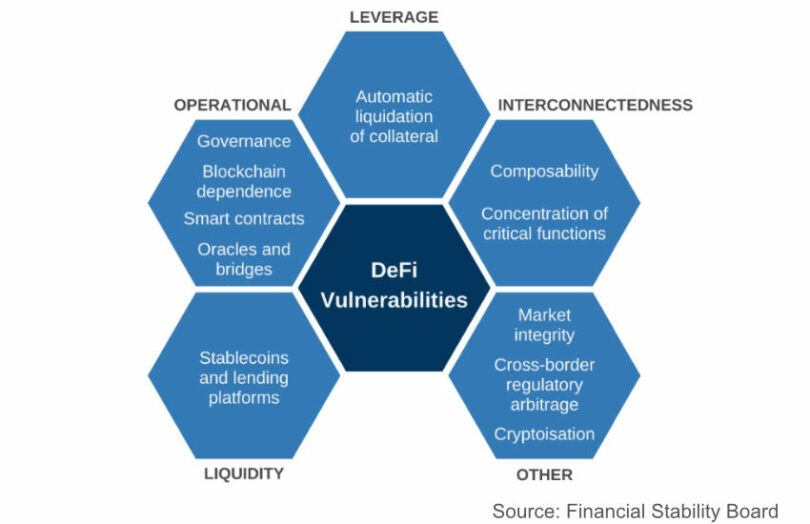

DeFi vulnerabilities include operational fragility, liquidity and maturity mismatches, leverage and interconnectedness.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.