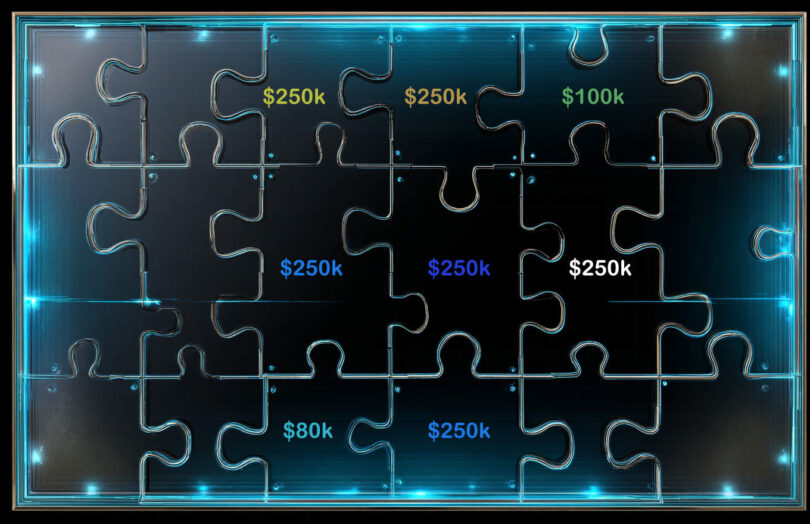

Today Fiserv unveiled a new solution INDX, targeting deposits from digital asset firms. INDX acts as an agent splitting large deposits and allocating the balances to numerous community banks and credit unions, each carrying deposit insurance of up to $250,000. The Fiserv Deposit Network has 1,100 banking members.

Hence a $25 million deposit spread over 100 banks could be fully insured. The emphasis on community banks and credit unions leans into the current concerns that stablecoins could attract deposits away from local banks, impacting community lending.

In addition to distributing deposits, the Fiserv solution supports 24/7/365 instant payments and programmability. However, the solution is not blockchain based, instead providing a conventional API. Fiserv was able to launch the solution speedily after acquiring deposit aggregator StoneCastle in December 2025.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.