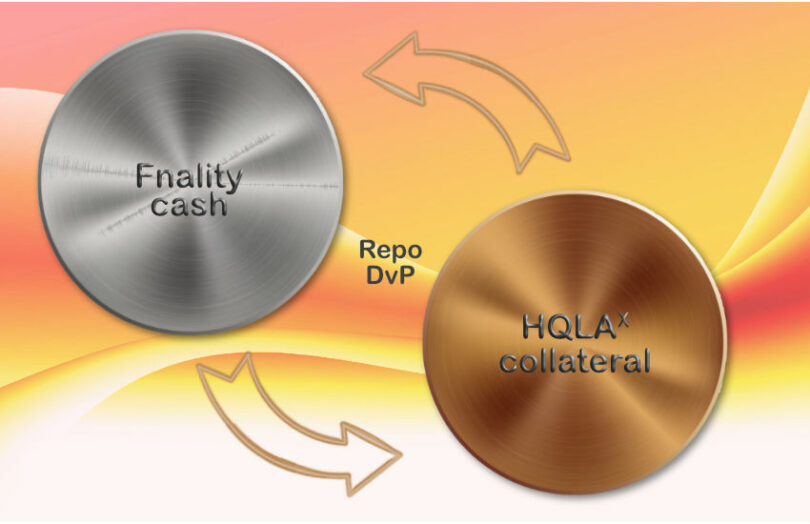

Today bank-backed blockchain firms Fnality and HQLAᵡ announced they completed end to end testing to enable intraday repo settlement. They plan to allow trades on the Eurex Repo F7 system to settle via the two blockchain networks, with a production launch scheduled in Q4, subject to UK regulatory approvals. Fnality is the UK-regulated systemic payment system that went live in December and HQLAᵡ operates its Digital Collateral Registry to enable intraday collateral movement.

The key advantage is the ability to settle trades at a specific time of day, enabling institutions to execute intraday repurchase agreements (repos) and have granular control over their liquidity. In conventional repos, the collateral settlement usually takes two days. For example, UK gilts can be lent in exchange for cash, and the transaction is reversed days later.

Simone Cortese, Fnality’s Director of Product Management, described the benefit to Ledger Insights. He gave the example of loaning out some collateral, “getting into these repos at 8 AM in the morning, closing them at 2 PM. That’s an unprecedented level of control of that collateral and cash management. That’s really the vision.”

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.