The National Bank of Ukraine has released results of a survey exploring the possibility of introducing a central bank digital currency (CBDC). The questionnaire targeted 100 financial experts in various sectors, including retail (45%) and those knowledgeable about financial markets (36%).

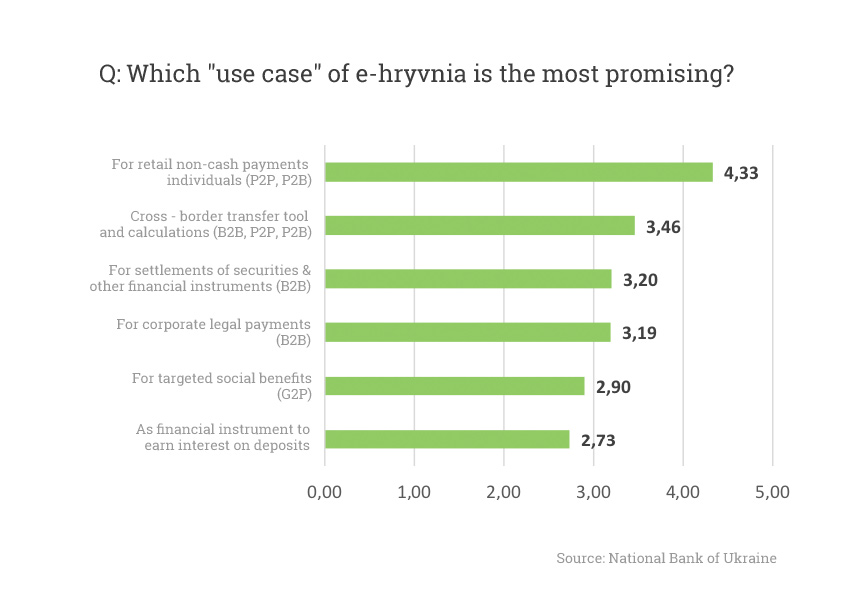

An e-hryvnia for conducting cashless retail payments was found to be the most promising case, particularly for e-commerce transactions. As a result of the survey, the three chosen use cases are cashless retail payments, including programmable money, use for virtual assets transactions and cross border payments.

Unlike countries such as Sweden, Ukraine’s primary motivations for a CBDC seem not to be driven by the disappearance of cash. When asked what the e-hryvnia would replace, 69.4% said it would be a surrogate for other electronic money (e-money) transactions. Last year e-money transactions were up 15% despite the total balances dropping because of providers exiting the market. In third place, 55.7% responded that the CBDC would be used instead of cash.

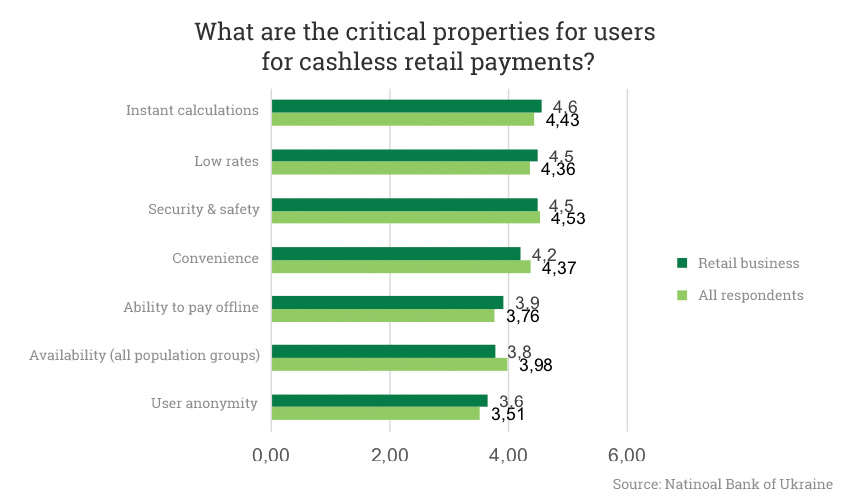

The drive for an e-hryvnia in Ukraine will facilitate faster, more secure electronic transactions.

A key benefit of a digital currency is the potential for lower payment costs. In Ukraine, many cashless transfers are conducted via P2P transactions using card payment systems, which are expensive. A central bank currency would reduce these costs and increase payment system efficiency. However, when asked about business models, the CBDC is expected to be free for topping up and redemption, but payments are anticipated to incur some costs.

The National Bank of Ukraine began working on the e-hryvnia in 2016, launching a pilot program in 2018 to issue the digital currency for retail payments on a blockchain platform.

Meanwhile, Ukraine is currently working on a CBDC project with the Stellar Development Foundation, which is focusing on the infrastructure for a Ukrainian national digital currency. Notably, the project is also exploring the possibility of using stablecoins via the Stellar blockchain.