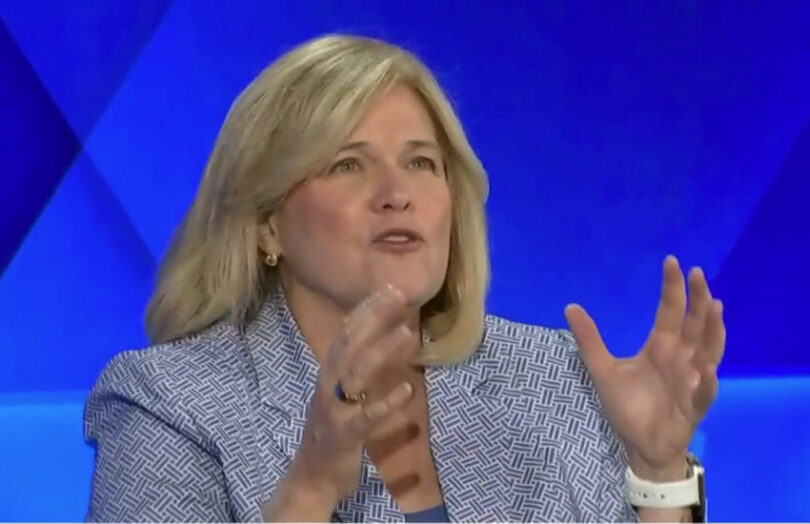

Jenny Johnson, the CEO of asset manager Franklin Templeton, said tokenization is securitization on steroids. She was talking during the CNBC Delivering Alpha event. As bullish as she is about blockchain, she’s also pragmatic that it’s a long game.

Ms. Johnson discussed how public companies must invest in the future given the current technological changes. And she referenced her own role in Franklin Templeton’s commitment to blockchain. “We’re doing a lot in that space. But I don’t think it pays off for five, seven, ten years,” she said.

Franklin Templeton has a tokenized money market fund that has on chain assets of $296 million. However, despite the transfer agent using public blockchain, for now it also has a conventional database for SEC compliance.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.