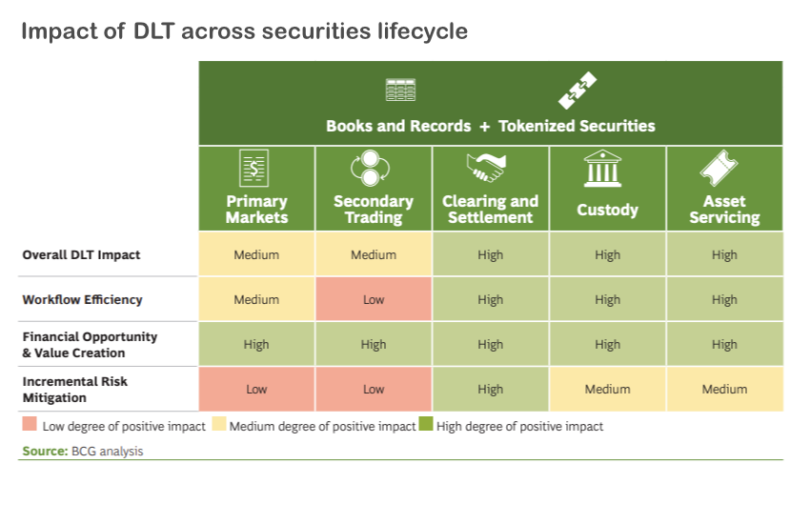

Today the Global Financial Markets Association (GFMA) published a report on the impact of DLT on capital markets. With the Boston Consulting Group (BCG) as one of the co-authors, it reiterates the potential to tokenize $16 trillion in illiquid assets by 2030. It also estimates that DLT could free up $100 billion in collateral that could be deployed elsewhere. And an older Santander report predicts that DLT could provide $15-$20 billion in savings annually through settlement and corporate action efficiencies.

“We expect global infrastructure, operational cost, and financial resource efficiencies to deliver more than $100 billion (USD) in annual savings and freed capital when adopted at scale globally, driven by smart contract process automation, streamlined back office functions, and lower settlement and counterparty credit risk,” said Roy Choudhury at BCG.

The paper focuses on tokenized securities and security tokens and does not cover cryptocurrencies. It differentiates between blockchain used for books and records versus tokenization.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.