Today the Global Financial Markets Association (GFMA) published a report on the impact of DLT on capital markets. With the Boston Consulting Group (BCG) as one of the co-authors, it reiterates the potential to tokenize $16 trillion in illiquid assets by 2030. It also estimates that DLT could free up $100 billion in collateral that could be deployed elsewhere. And an older Santander report predicts that DLT could provide $15-$20 billion in savings annually through settlement and corporate action efficiencies.

“We expect global infrastructure, operational cost, and financial resource efficiencies to deliver more than $100 billion (USD) in annual savings and freed capital when adopted at scale globally, driven by smart contract process automation, streamlined back office functions, and lower settlement and counterparty credit risk,” said Roy Choudhury at BCG.

The paper focuses on tokenized securities and security tokens and does not cover cryptocurrencies. It differentiates between blockchain used for books and records versus tokenization.

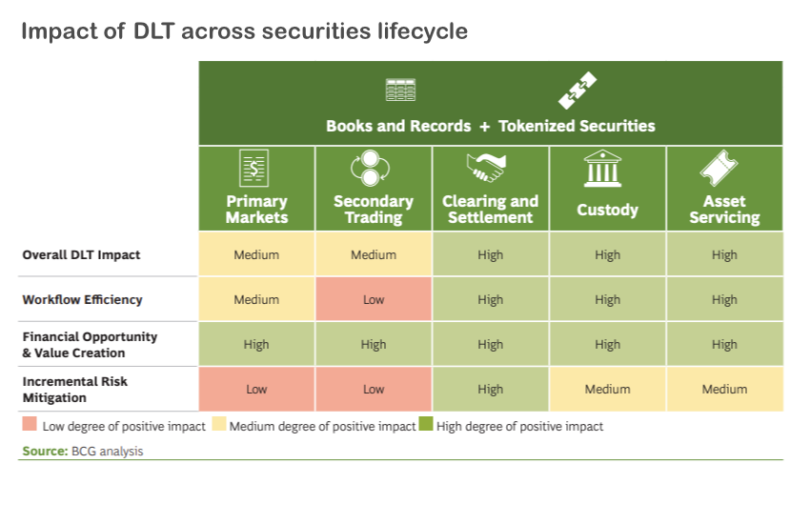

One of the most useful sections of the 188-page report is an analysis of where DLT adds value across the securities lifecycle. The greatest benefits can be seen in post trade, starting with clearing and settlement, and followed by custody and asset servicing. Primary and secondary markets benefit a little less, but the main impact is the potential opportunities that DLT can offer in terms of broadening investor access and fractionalization.

Unsurprisingly, the report comprehensively covers regulation with co-authors Cravath, Swaine & Moore and Clifford Chance involved. They write, “Punitive penalties for the use of a particular technology, without clearly defined risk-based justification, could be detrimental to innovation in the market and have unintended consequences on the evolution of a future DLT-based market structure within the regulatory perimeter.”

The GFMA makes several recommendations to drive DLT forward, including regulatory harmonization, interoperability, and industry collaboration. While some central banks are leaning towards linking RTGS systems for settlement, the paper definitively calls for DLT-based payment solutions, including tokenized commercial bank deposits.

One of the standout recommendations is about pooling liquidity. If institutions focus on specific asset classes, they can target solutions that will pool sources of liquidity, which will “increase the chances of attaining a viable market.” The paper acknowledges that in the early days, a small number of digital securities have been issued on siloed platforms, which doesn’t help liquidity. This focus is already happening with the bond market as a target.

“The goal of our latest report is to help policy makers and financial market participants to find a way forward that ensures appropriate stability and protections, while also allowing the industry and economy to harness the benefits of this new technology,” said Adam Farkas, GFMA CEO.