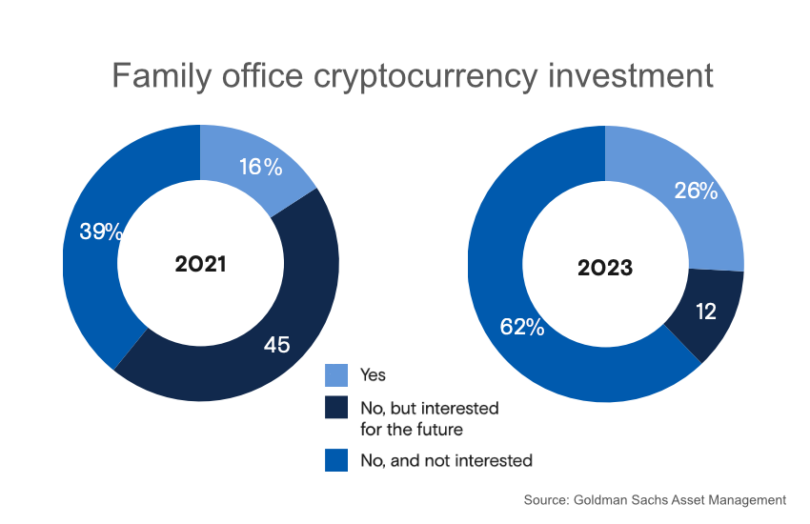

Goldman Sachs released its latest survey of 166 family offices, with 72% managing more than $1 billion in assets. It found an enduring interest in alternative assets that comprise 45% of their portfolios. Cryptocurrency holdings are still small, but 26% of family offices have invested, up from 16% in 2021. The figure rises to 32% for the broader definition of digital assets.

However, in the 2021 survey, a large proportion of investors considered cryptocurrency an option in the future. That figure has dropped sharply, resulting in 62% of family offices having no interest in investing in cryptocurrencies, up from 39% in 2021. The change of mind was the biggest in the Americas, but 79% of EMEA family offices do not intend to invest.

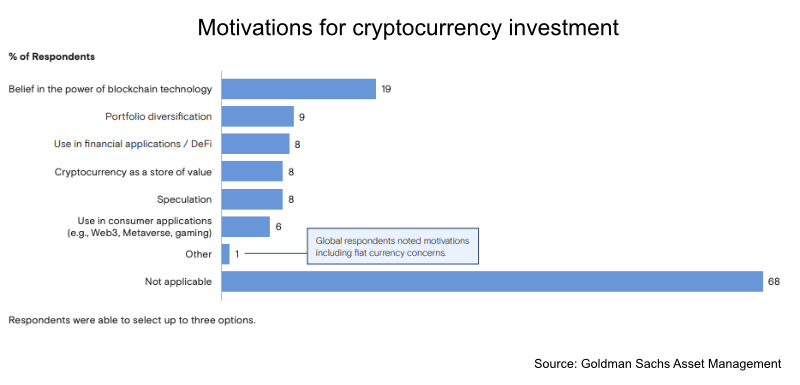

When asked for investment motivations, by far the greatest driver was a belief in the power of blockchain technology at 19%.

The outsized interest in alternative investments was echoed in a recent wealth survey by Bank of America. It explored the potential for changes as generations pass on wealth. It found wealthy high net worth investors aged 42 or less had a far greater interest in alternative investments and crypto and digital assets ranked as the top asset class. That survey was conducted in the second half of 2022, whereas the Goldman one was earlier this year.