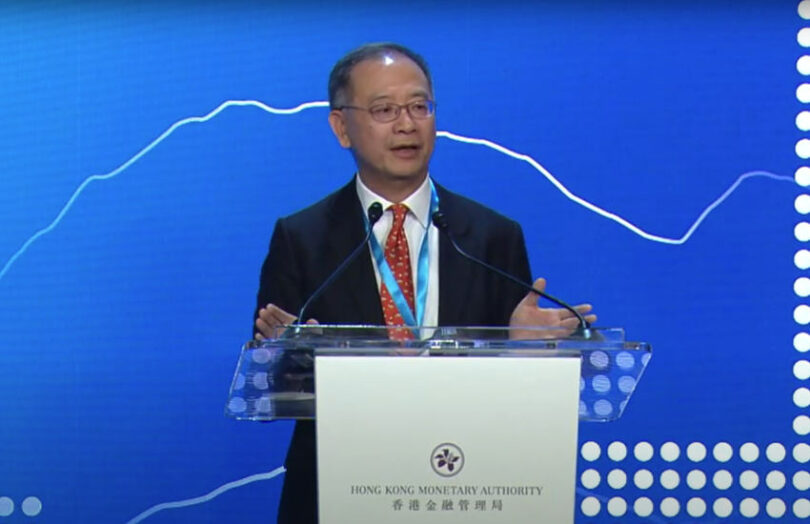

During a speech yesterday Eddie Yue, CEO of the Hong Kong Monetary Authority (HKMA), discussed the future of digital money in the tokenization era. He touched on retail central bank digital currency (CBDC), stablecoins, tokenized deposits and wholesale CBDC. Its work on a retail CBDC is quite advanced, but Mr. Yue was nonetheless cautious.

“It remains to be seen whether the benefits of its issuance would outweigh the risks,” he said, outlining a need to assess the impact on the broader financial system. That likely means global concerns about the impact on bank deposits. He added, “We will continue to take a use-case driven approach in thinking about whether and when to introduce a retail CBDC.”

Last month the central bank opened applications for participants in its second phase of retail CBDC trials. During 2022 as part of Project Aurum it also explored a CBDC-backed stablecoin. This mirrored the way Hong Kong authorized three banks to issue physical bank notes. Hence, these were not typical stablecoins but what Mr. Yue described as ‘close cousins’ of CBDC.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.