Last year the Hong Kong Monetary Authority (HKMA) launched Project Ensemble, with the aim of exploring tokenization including for settlement. Inspired by the BIS, the HKMA created a unified ledger with a view to offering a wholesale CBDC. In turn the wholesale CBDC enables the settlement of tokenized deposits when money is transferred between banks.

After unveiling the project in March, a sandbox was launched in August 2024. The sandbox explored four themes: the tokenization of financial instruments such as the Hong Kong digital green bonds, tokenized corporate payments and liquidity management, green use cases including carbon credits, and trade finance.

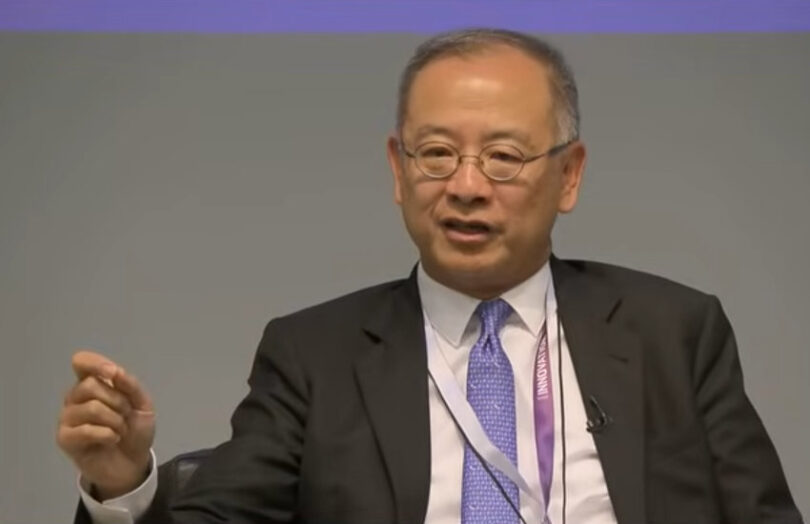

For any of these use cases to go live using tokenized settlement, the central bank will need to provide a production infrastructure including the ledger and wholesale CBDC. HKMA CEO Eddie Yue revealed that this infrastructure will be in place by the end of the year.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.