On Twitter earlier this month, Finnish central banker Aleksi Grym asked the excellent question, “Is there any difference between stablecoins and e-money?”

E-money is a legal concept in many jurisdictions such as Europe and Singapore, but not in the United States. And Europe wants to regulate stablecoins as e-money, which could reduce the current functionality of stablecoins, such as the ability to earn interest.

Here the stablecoin focus is on 1-to-1 fiat-backed, such as Tether, USDC and the planned Diem USD.

Typical examples of conventional e-money include PayPal and prepaid debit cards. While the best drafted legislation attempts to be technology agnostic, sometimes a technology comes along that expands what was previously imagined. Perhaps blockchain is one of those technologies.

PayPal v stablecoins

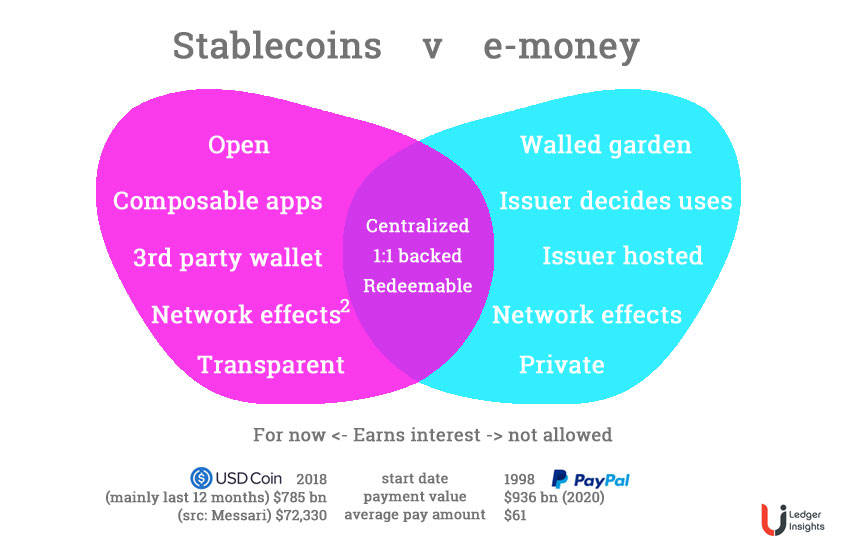

In comparing conventional e-money to public blockchain stablecoins, PayPal is used as an e-money example.

Stablecoins inherit several features native to a public blockchain. The blockchain is open, smart contracts are composable and the tokens are tradeable.

As a PayPal user, I’m regularly frustrated by the experience. Yes, I can transfer money to my bank account. But it’s pretty hard to transfer money directly to or from another e-money provider. And I want to because compared to other e-money firms, PayPal charges a small fortune for converting between currencies. It’s easy to assume the reason for the friction is that foreign exchange is one of PayPal’s business models.

This demonstrates that most e-money operates within walled gardens, which by definition means there’s a limited ability to trade with other forms of e-money or other assets. Sure, PayPal now supports cryptocurrencies. But those cryptocurrencies are also held within that walled garden. Currently, they can only be sold via PayPal or used to pay a merchant.

In the early days of the internet, there were two big internet access providers, Compuserve and AOL. They tried to keep users within their walled version of the internet rather than providing unfettered access to the broader web. That didn’t last.

With a stablecoin, I can freely switch to another stablecoin, albeit I need to pay the gas transaction costs. The only walls are the blockchain on which the stablecoin operates. But even those walls are being broken down.

Openness exaggerates network effects

There’s another side effect of the openness of stablecoins. Most payment systems, including e-money, demonstrate network effects. But the more open it is, the greater the network effects. In some countries such as China and Sweden, one or two conventional e-money providers have become the dominant retail payment mechanisms. With the greater network effects of stablecoins, regulators are concerned about the magnitude of a big tech stablecoin, because they know it can grow very rapidly. The figures in the graphic paint part of that story.

This openness and ability to trade do not conflict with most e-money legislation, but the next point does.

Composability and stablecoins

The most fundamental difference between conventional e-money and stablecoins is the composability feature of blockchains. That means stablecoins can earn interest, which is often forbidden for e-money.

Without authorization from a stablecoin issuer, any developer can create a smart contract that uses that stablecoin. The computer code might add programmable features to use the stablecoin for conditional or regular payments. The smart contract could be a trading system, a solution to earn interest or one that lets the stablecoin be lent to someone else.

All of these use cases already happen, and this is where the legal definition of e-money and stablecoins diverge. E-money issuers are regulated in terms of functionality, but stablecoin issuers don’t know how their stablecoin might be used.

Contrast that with PayPal, which decides precisely which features can be offered.

Most e-money regulations ban interest payments as the price for not imposing onerous banking rules. Earning (good) interest on stablecoins is a hugely popular decentralized finance (DeFi) application and there are even bigger centralized players. Roughly a third of the entire USDC stablecoin balance is sitting on deposit with just two DeFi lending protocols.

In some regions, e-money regulations state that the e-money issuer cannot pay interest, and given stablecoin issuers generally do not, this is not a problem (eg. UK, Ireland, Singapore). While some stablecoin issuers don’t directly offer interest, they promote and facilitate access to third parties that do.

In other jurisdictions – including much of Europe – e-money regulations state that e-money cannot earn interest without mentioning who pays the interest. In other words, a stablecoin is not allowed to earn interest.

That’s a challenge. How can a stablecoin issuer stop someone else from using their stablecoin to earn deposit interest?

Actually, they can.

Every stablecoin is itself a smart contract. It may be impossible to guarantee it can’t earn interest, but it’s conceivable to restrict its transfer to specific blockchain addresses. And most DeFi involves transferring cryptocurrencies to other addresses, including earning interest from a lending protocol. There could be a dynamic list of addresses to which the stablecoin cannot be transferred. The security token standard ERC-1400 works similarly but instead allows transfers to approved addresses.

On the one hand, this would adhere to regulatory requirements. On the other hand, it starts to chip away at the openness promised by blockchain.

Separation of roles and transparency

It’s not just lending that’s via a third party. So are payment transaction costs which currently mainly go to blockchain network operators.

The split also applies to custody. With PayPal, my e-money is in a PayPal wallet. With a stablecoin, it’s rarely in a wallet created by the stablecoin issuer. For most users, the stablecoins will be held in an exchange wallet or perhaps a Facebook Novi wallet in the future. And in some cases, it will be in a self custodied wallet.

That has several implications, including that wallet providers may or may not be regulated. And the fact that a third party gets to see your transactions, albeit one that you choose.

On that point, transparency may be one area where perhaps PayPal wins. My PayPal transactions are kept within that walled garden. In contrast, my stablecoin transactions can be seen by anyone that looks at the blockchain, albeit they appear pseudonymously.

In China, the digital yuan offers the concept of sub wallets so that your payments to one online store cannot be easily linked to others. However, if you transfer from one wallet to another in the blockchain world, it can be tracked.

Much of Google’s ad tracking is also pseudonymous. But it purchased data from Mastercard to give it a better picture. It’s possible to identify most stablecoin wallet addresses by combining crytocurrency exchange data and blockchain forensics from firms such as Chainalysis. Coincidentally, Chainalysis recently launched a ‘Business Data’ product to provide better customer intelligence.

This analysis has highlighted that stablecoins have features that differ from conventional e-money. But it’s hard not to conclude that each point is just a symptom of one primary difference: stablecoins are issued on a public blockchain.

This is the first of a multi-part series.

The author is not a lawyer and this article is not legal advice.