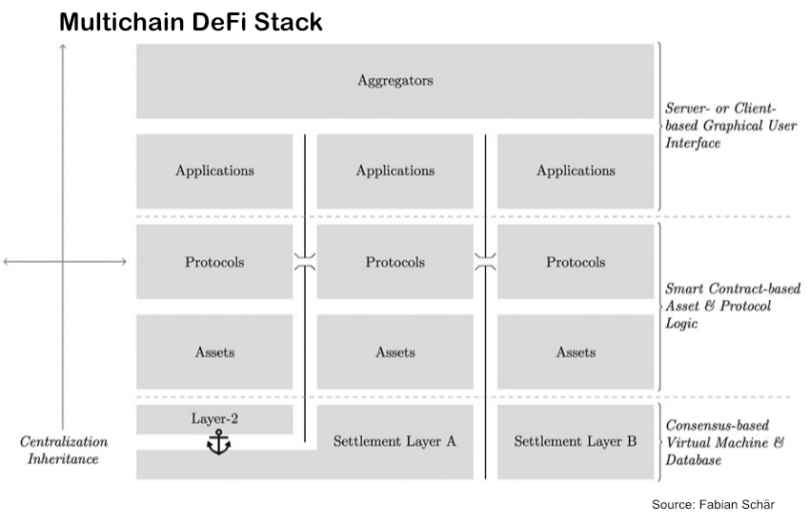

A recent academic paper on the potential regulation of decentralized finance (DeFi) goes substantially deeper than those before it. One of the authors, Fabian Schär, penned a 2021 DeFi paper that separated DeFi into functional layers. The paper focuses on these layers in search of centralization. What’s refreshing is that despite the authors being fans of DeFi, their centralization assessment is clear and intellectually honest.

They conclude that “most of what is commonly referred to as DeFi have severe centralization vectors.”

In most cases regulators use the principle of ‘same activity, same risk, same rules’ to assess who to regulate. The “who” is based on identifying individuals or organizations involved in centralized activities.

In addition to the DeFi layers used to explore centralization, other features of DeFi can introduce centralization elements. One of these is the composable nature of smart contracts, or what’s commonly referred to as money Legos. Even if an assessment concludes that a project is “Genuine DeFi”, it might depend on other assets, protocols or blockchains with some level of centralization. Hence, that could render a DeFi project as “on-chain CeFi” alongside other projects that are more internally centralized.

Much of the paper focuses on two centralization topics – the core blockchain layer and the asset and protocol layers. Unsurprisingly, permissioned blockchains are considered inherently centralized.

The blockchain or settlement layer

At the blockchain level, the authors highlight that some chains have multiple open source implementations where no dominant provider could set standards. This argues in favor of decentralization. That said, we’d observe Ethereum is one of the few chains with multiple software clients, but even then, it is still fairly concentrated.

Next the paper explores the three main consensus protocol types: Proof of Work (PoW), Proof of Stake (PoS) and Proof of Authority (PoA). Looking at the fundamentals, it splits the consensus process into nodes versus resources and explores the potential for centralization.

Proof of Authority is inherently centralized. In the case of Proof of Work, the resource used is computation power versus tokens in Proof of Stake (PoS). Proof of Work (PoW) is the most likely to be decentralized of the three because there is no restriction on participating nodes, nor is there control over computational power. With Proof of Stake, using tokens for staking means decentralization depends on a lack of concentration in ownership of the blockchain’s native token.

Pooling of capacity in both PoW and PoS can introduce centralization.

Desirable TradFi features introduce centralization

Turning to the asset and protocol layers, these are treated together because they’re both based on smart contracts. The analysis clarifies that some features seen as beneficial in traditional finance (TradFi) introduce centralization for a DeFi protocol.

One example is the introduction of allow lists and block lists. The creation of these lists is, by nature, centralized. It also introduces a risk for multiple protocols if the list blocks not just individual wallets but the address of a smart contract protocol. This could mean that many of the protocol’s users will be blocked from accessing assets. The example given was OFAC blocking of the crypto mixer, Tornado Cash. Many people used it simply for privacy, not because they did anything illegal.

The authors justifiably spend a lot of time exploring the potential for updating smart contracts. A smart contract that is not upgradeable has the least risk of centralized interference. But if something goes wrong, users need to migrate to a new contract, which could be expensive. To be fully upgradeable, others rely on proxy smart contracts, which point to the latest version of the code.

On the one hand, it’s good to be able to upgrade code for unforeseen circumstances. On the other hand, the new code could introduce bugs or malicious code. A multi signature keychain and a governance mechanism often control the ability to deploy a new smart contract. The paper explores the governance mechanisms in more detail.

A DeFi future

The authors argue that where DeFi is really decentralized, regulators should recognize the benefits of DeFi rather than purely focus on risks. These advantages include potentially addressing some of the risks of TradFi, enhancing financial inclusion and improving transparency.

While some protocols currently sit in a grey area, they predict that most will move to the extremes over time. In other words, most protocols will either become on-chain CeFi or genuine DeFi. In the latter case, they consider the only rational approach is to regulate the on-ramps and off-ramps.

This isn’t one of those papers where a summary does it justice. It’s well worth reading the full text.