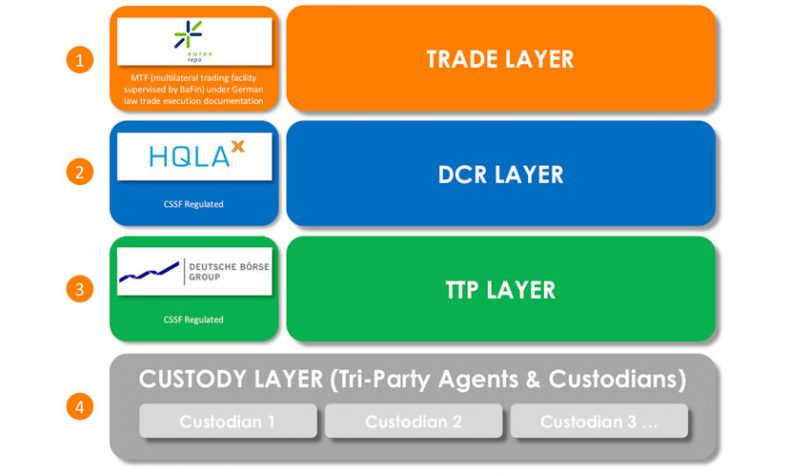

Today HQLA

X announced plans to go live with its distributed ledger platform in November. The Luxembourg startup enables efficient securities lending by allowing a transfer of assets or collateral swaps through a digital collateral registry. The platform was jointly developed with the Deutsche Börse Group, which is also an

investor in HQLAX.

Banks swap different qualities of assets to ensure they stay in compliance with Basel III capital adequacy requirements. The purpose of HQLA

X is to reduce the friction in the process.

As it prepares for launch, HQLA

X executed several simulated trades with ING, Commerzbank and other global banks. Generally, with a collateral swap, the custody of the collateral would need to be moved. Instead, by using the digital collateral registry, the underlying basket of assets remain off-blockchain and untouched with the original custodian. In the simulation, the assets resided at Clearstream Banking (owned by Deutsche Börse) and Euroclear Bank.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.