Today HQLAX announced plans to go live with its distributed ledger platform in November. The Luxembourg startup enables efficient securities lending by allowing a transfer of assets or collateral swaps through a digital collateral registry. The platform was jointly developed with the Deutsche Börse Group, which is also an investor in HQLAX.

Banks swap different qualities of assets to ensure they stay in compliance with Basel III capital adequacy requirements. The purpose of HQLAX is to reduce the friction in the process.

As it prepares for launch, HQLAX executed several simulated trades with ING, Commerzbank and other global banks. Generally, with a collateral swap, the custody of the collateral would need to be moved. Instead, by using the digital collateral registry, the underlying basket of assets remain off-blockchain and untouched with the original custodian. In the simulation, the assets resided at Clearstream Banking (owned by Deutsche Börse) and Euroclear Bank.

One of the advantages of blockchains or distributed ledger technology (DLT) – in this case R3’s Corda – is they enable instant settlement. While swaps don’t involve cash, the simultaneous swapping of assets amounts to delivery versus delivery (DvD).

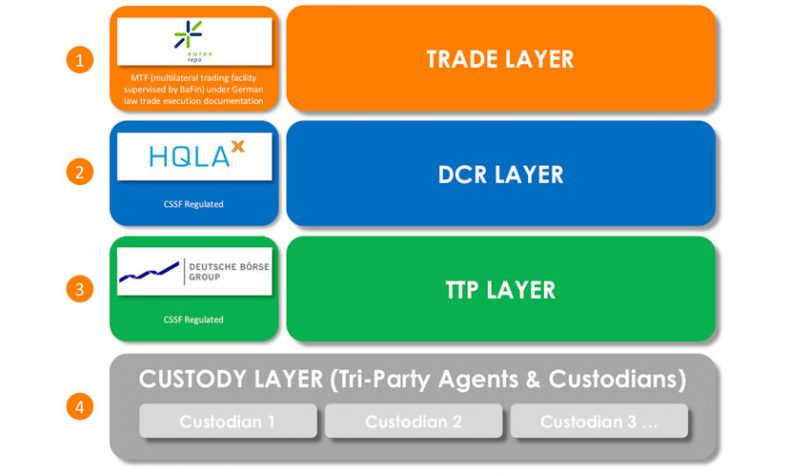

“The successful execution of these simulation transactions is particularly important because they test the front-to-back trade flow across the four layers of the HQLAX operating model. As such, the simulation transactions are a key milestone in our client on-boarding journey,” said Guido Stroemer, CEO of HQLAX.

Between the custodians and HQLAX sits an entity called the Trusted Third Party (TTP) which is owned by Deutsche Börse Group. The diagram above shows where HQLAX fits in. JP Morgan runs a Tri-party programme which deals with the post-trade processing of collateral swaps. And JP Morgan has started to onboard Deutsche Börse’s TTP as a Collateral Receiver and Collateral Account owner.

That’s a big step because the main tri-party agents in Europe are Clearstream Bank, Euroclear Bank, JP Morgan, BNY Mellon, and SIS.

A major benefit of HQLAX is it can improve intraday liquidity. An early-stage startup also targeting intraday liquidity is Finteum. The London company also uses R3’s Corda technology and is enabling intraday FX swaps.