Yesterday Bakkt launched its rewards and digital asset wallet to the public. The startup was founded by New York Stock Exchange owner ICE, which still controls 65% of the equity after a SPAC listing that made the merged company a unicorn twice over. However, ICE no longer has majority voting rights.

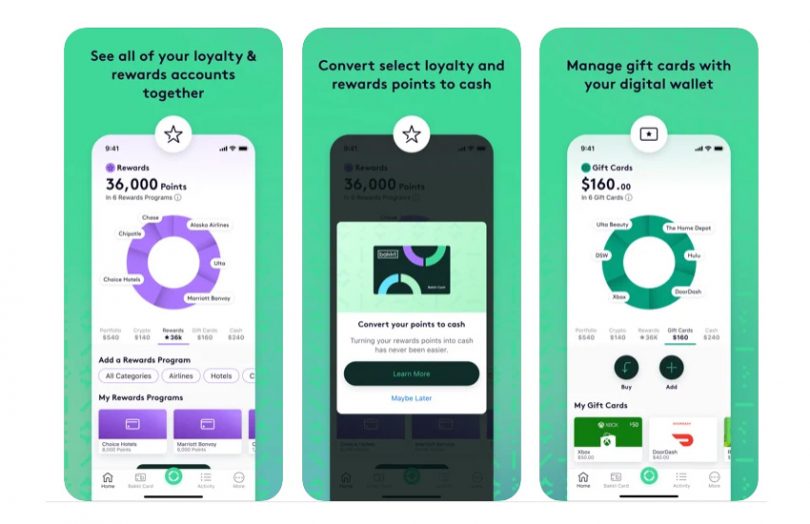

The Bakkt App has been ‘invitation only’ for some time, and the company says that 500,000 people participated in the Early Access Program. Although based on iOS AppStore reviews, some were lured by a free $10 to spend. Its big vision is to provide a single wallet where users can store cryptocurrencies, cash, rewards points, gift cards and in the future, digital stocks. But more than that, any rewards points can be converted to cash and used to make payments. So theoretically, in future one could use air miles to pay for Starbucks.

The company started out with a Bitcoin futures contract but pivoted to focus on rewards. To do so, it paid almost $300 million to buy loyalty technology firm Bridge 2 Solution. At launch, the Bakkt App highlighted five partners Starbucks, GolfNow, Best Buy, Choice Hotels and Fiserv.

“The average consumer holds a wealth of digital assets – from gift cards to loyalty points to bitcoin – but lacks the tools to adequately track and utilize their value,” said Bakkt’s CEO, Gavin Michael. “We’re thrilled to bring the Bakkt App to the public as a step along our journey to expand digital asset access to all.”

However, as we previously highlighted in our analysis, while the vision is faultless, the question is how many loyalty programs are willing to convert their points to cash? And the Bakkt App needs a lot of corporate loyalty participation to make the App attractive to consumers. That said, several of the AppStore reviewers seemed keen to store all their rewards programs in one place, even if they can’t convert them to cash.

Below are high-level details about the five deals, and we’ll highlight some points later. Starbucks now allows its iOS app users to use Bakkt stored bitcoin, rewards points or other Bakkt assets to top up a Starbucks card. Best Buy provides exclusive deals to Bakkt users using the Bakkt Visa Debit Card. Bakkt “is working with Choice Hotels to enable” its rewards to be used via the Bakkt App. Fiserv enables uChoose Rewards points to be converted to cash within the Bakkt App. And Bakkt is sponsoring GolfNow so that its members will be able to use Bakkt App for payments.

Of the five deals, only two are with loyalty programs. The ability to use digital assets for payments is a matter of converting them to cash at checkout. It’s not trivial, but it has already been done for numerous debit cards issued by cryptocurrency exchanges. So while the payments side is important, it’s not the challenge. The tricky part is signing the rewards programs.

The Fiserv – uChoose Rewards program we believe is operated by the Navigator Credit Union, which has 50,000 members who are not necessarily all uChoose rewards participants. And perhaps the most important deal is the one with Choice Hotels, which owns Comfort Inn and other brands. However, the Choice Hotels’ wording sounded somewhat cautious.

Both Choice and uChoose lean towards the budget end of the scale. That’s a good demographic for rewards users who might be keen on the cash conversion, although it’s unclear how much of a crossover there will be with cryptocurrency users. Most AppStore reviews seemed to relate to cryptocurrency functionality or rewards, only occasionally both.

On the other hand, some cryptocurrency users might be keen to spend stablecoins while in Starbucks. So the Starbucks deal may be important for the user numbers.

In conclusion, while we love the Bakkt App concept and hope they can pull it off, it’s still extremely early days.