Bakkt is the digital assets firm majority-owned by ICE, which also owns the NYSE. Today a Bloomberg report cited unnamed sources that said Bakkt is in advanced talks to merge with a listed special purpose acquisition vehicle (SPAC) VPC Impact Acquisition Holdings.

VPC is associated with Victory Park Capital, which raised around $200 million and yesterday had a market capitalization of $270 million. The combined value of the two firms is thought to be around $2 billion.

So what does Bakkt do and why float now?

Bakkt is really a play on mainstream consumer adoption of digital assets, focusing on loyalty and rewards to pull in consumers. Its consumer app is about to go fully into production. So the timing is likely to be at least as much about that as Bitcoin’s all-time high.

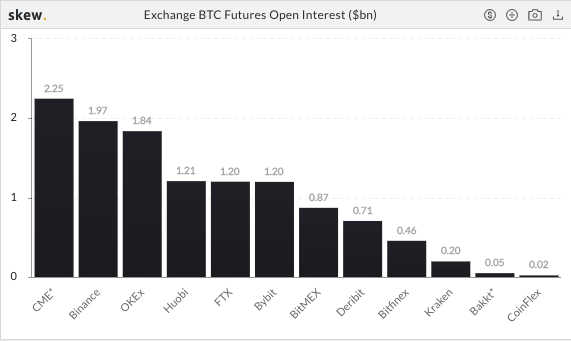

The startup initially focused on physically delivered Bitcoin futures, but it is not a massive player in the sector. Most Bitcoin derivatives are through offshore cryptocurrency exchanges, whereas Bakkt is regulated. However, according to analytics firm Skew, Bakkt’s futures volumes are a fraction of the CME’s – something like 2%. That’s despite Bakkt announcing record volumes in September.

In late 2018 Bakkt raised $182.5 million in its Series A, followed by a $300 million Series B round, which included ICE, Microsoft M12, Boston Consulting Group and others.

The firm used a large slice of the Series B proceeds to acquire rewards company Bridge2 Solutions. The technology company provides a solution for seven of the top ten financial institutions as well as 4,500 loyalty and employee incentive schemes, including two U.S. airlines.

The idea is that rewards are digital assets that can be tokenized and converted to cash. But once someone uses the wallet for that purpose, they may also be tempted to use it for payments and to buy cryptocurrency, two of the other key app features.

According to the Colloquy Loyalty Census, $48 billion in rewards points and miles are issued annually. And the average U.S. household is enrolled in 18 programs but only active in around eight. An app like Bakkt’s could encourage greater activity.

Meanwhile, Bakkt currently has an interim CEO in David Clifton, ICE’s VP of M&A and integration. This follows the founding CEO Kelly Loeffler departing in December 2019 to become a senator, a seat she has just lost. Her replacement was Mike Blandina, who switched to JP Morgan in May 2020. Don’t be surprised if Loeffler returns.