Today digital asset firm Bakkt and Victory Park Capital confirmed the company would list via a merger with Nasdaq quoted VPC Impact Acquisition Holdings. It also announced that Gavin Michael, former head of technology of Citi’s Global Consumer Bank, joins Bakkt as CEO.

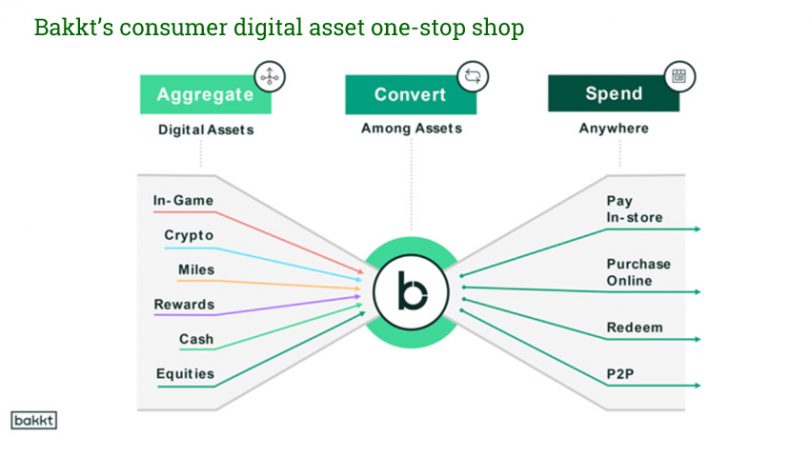

NYSE owner ICE, which founded Bakkt, will have a 65% equity interest post listing (down from 81%) but will retain less than majority voting rights. As previously noted, the key asset is Bakkt’s customer loyalty and commerce app, which digitizes reward points and provides a one-stop-shop for digital assets.

The merged firm has an enterprise value of $2.1 billion, of which $570 million is cash. That includes a simultaneous private equity investment (PIPE) of $325 million, of which $50 million comes from ICE.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.