An observation in the IMF’s recent Digital Asset Platforms paper is that conventional finance tends to tightly combine assets with the platform on which they exist. For example, a bank’s money is only usable on its own banking platform. In contrast, with digital assets, the asset could exist on multiple platforms. Consider a stablecoin issued on multiple blockchains.*

Interoperability is widely recognized as a topic that sorely needs addressing for digital assets. The internet protocol TCP/IP is credited with enabling internet interoperability. The IMF authors ask, “What is the TCP/IP equivalent for digital assets?” They borrow another concept from the internet era, the OSI model, which separates networks into layers.

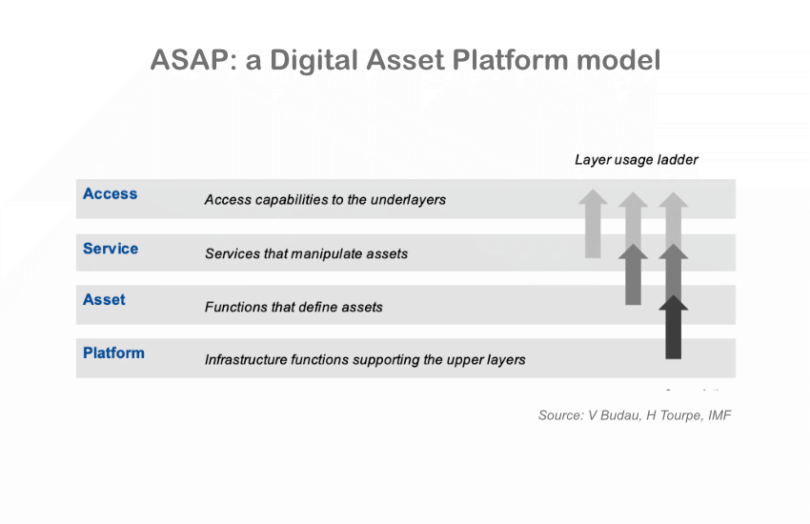

For digital assets the authors define four layers that make up a Digital Asset Platform (DAP), the ASAP model. The layers are

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.