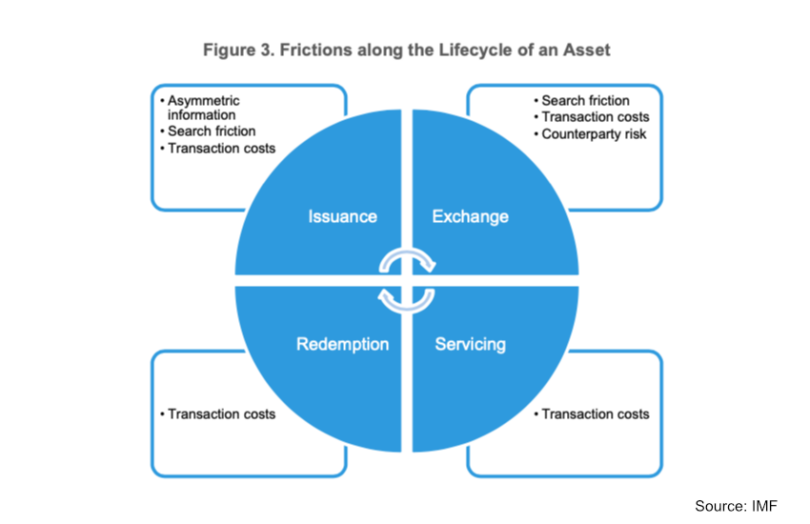

The International Monetary Fund (IMF) published a paper on Tokenization and Financial Market Inefficiencies. As per the graphic, it identifies inefficiencies at every stage of an asset’s lifecycle which can be addressed by tokenization. The ability to combine a shared ledger and programmability in the same system helps to cut costs, frictions and risks as well as improve transparency. While the authors spend almost as much time on the benefits as the risks, given this is an IMF paper, we will look at the highlighted risks because that could inform future regulations.

What follows is not a summary. It covers a subset of the issues raised, with examples and opinions added.

The authors note that the increased interlinking between market players is what enables many of the cost and friction reductions, but can at the same time elevate risks.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.