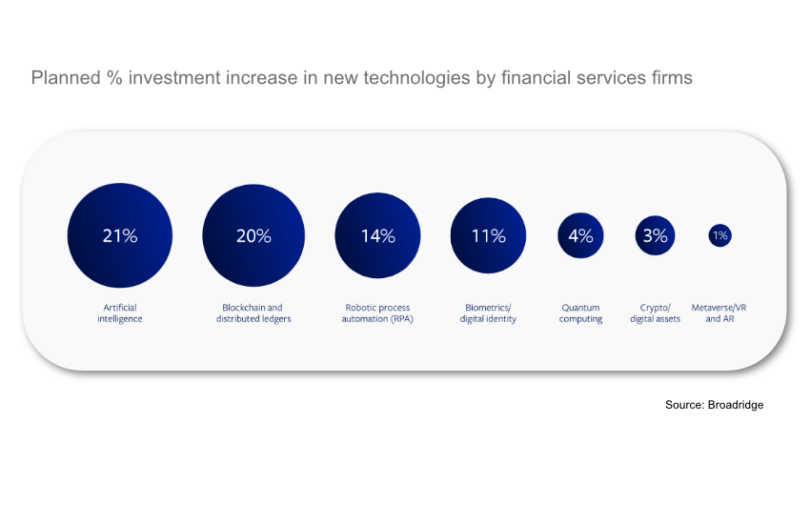

Over the next two years, firms in the financial services sector plan to increase investment in DLT by 20%, which only slightly lags AI (21%). That’s according to a digital transformation survey conducted by Broadridge based on responses from 500 senior executives.

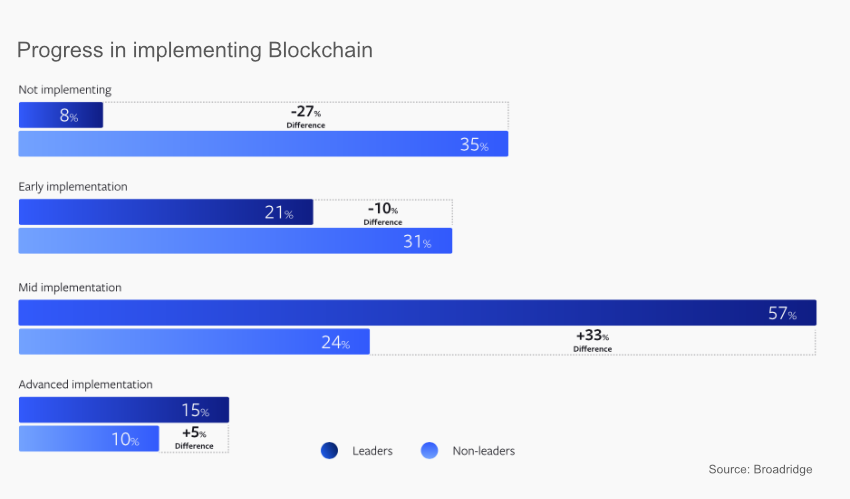

One of the features of the research was a classification of companies into technology leaders or non-leaders based on several factors. For example, the traits included an innovation culture, adoption of automation, and a modern core IT infrastructure. Companies that scored in the top quartile were classified as leaders.

Unsurprisingly, companies that are leaders scored higher adoption rates across most technologies. However, the gap was smaller for some technologies. For example, 85% of leaders prioritized investments in cloud platforms, only 1% ahead of non-leaders. In contrast, 44% of leaders are making moderate to large generative AI investments, double the rate of non-leaders.

Regarding blockchain and DLT implementation, 92% of leaders are engaged compared to 65% of non-leaders. Leaders are more advanced, with 72% progressing to mid or advanced implementation compared to 34% for non-leaders.

One of the questions asked whether DLT would reduce the need for custodians and clearinghouses for post-trade and issuance. Thirty-six percent of respondents agreed.

Horacio Barakat, Broadridge’s head of digital innovation and DLT, said, “Rather than seeing projects in isolation, leaders having increasing amounts of data and experience to make informed decisions about where these (DLT) technologies will provide tangible, meaningful benefits.” Bakarat is also the project lead for Broadridge’s Distributed Ledger Repo (DLR), which processes around $1 trillion in transactions monthly.