Masayoshi Son, the founder of SoftBank, raised a few eyebrows when he revealed talks to buy a minority stake in Swiss Re, in large part because Swiss Re operates outside SoftBank’s usual sweet spot. The reinsurer is the largest in the world, writing almost three times the premiums compared to Warren Buffet’s Berkshire Hathaway. So how is SoftBank’s interest in Swiss Re related to blockchain?

Blockchain is driving the automation of processes between insurers, brokers, and reinsurers, significantly reducing costs. The combination of blockchain, Artificial Intelligence (AI), the Internet of Things (IoT) and telematics will transform the insurance industry in the coming five to ten years, resulting in winners and losers.

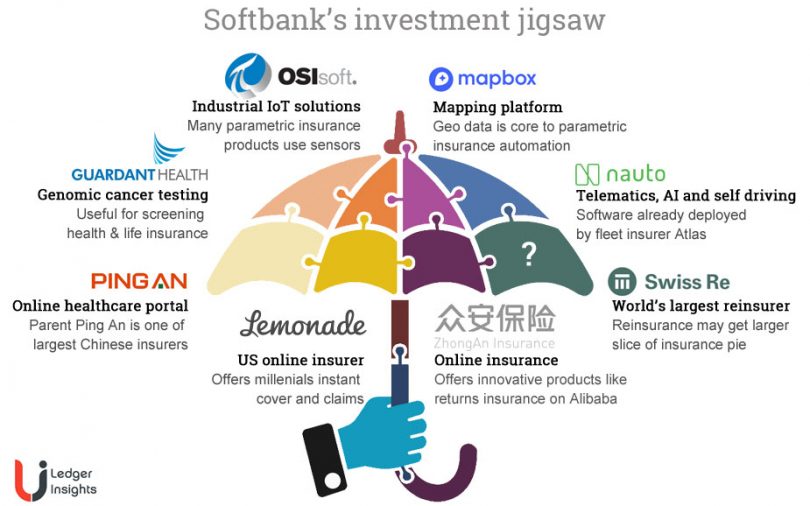

SoftBank has investments in several of these technologies as well as backing two direct insurers: the US based Lemonade and the innovative Chinese insurer, ZhongAn, which already uses blockchain technology.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.