If you’re familiar with blockchain and parametric insurance what comes to mind is gadget insurance, flights, and the gig economy. Instead, Skyline Partners targets the under and uninsured markets for weather events. The London insurtech’s first initiative will be a weather catastrophe insurance product for Indian tea farmers which will launch in the first half of 2019.

The protection gap

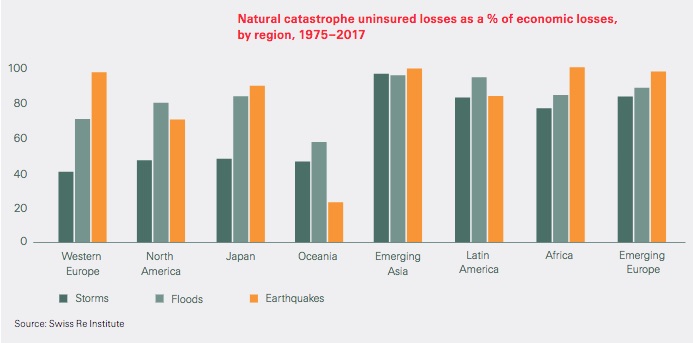

According to Swiss Re Institute in the last ten years, only 30% of catastrophe losses were insured. That means 70% ($1.3 trillion) is not covered and those losses are borne by individuals, business, and governments.

There are several reasons for the under insurance. A lack of knowledge or available products plays a role. But a large part is that insurance is not affordable. Plus there’s insufficient trust in insurers.

When it comes to affordability, parametric insurance and blockchain can make a difference in three ways. Firstly, blockchain cuts the paperwork and reconciliation costs. Secondly parametric radically reduces the expense of processing claims. Thirdly, there’s potential to spend less money on intermediaries. And lower costs means lower premiums.

Skyline is not the first to target blockchain and parametric. In terms of enterprise initiatives, one of the highest profiles ones is MetLife’s insurance for gestational diabetes.

Tea plantation catastrophe insurance

Gethin Jones and Laurent Sabatié both recognized the opportunity and teamed up in October last year.

Jones has a background in innovation and change management at RSA and Chaucer Syndicates. And Sabatié is a qualified actuary and worked for years at Axa and AIG as well as a specialist Lloyds syndicate.

They visited India in January and returned in March to conduct workshops with tea estate owners to establish if a weather product would be of interest. After positive feedback, they traveled to Assam to visit the tea estates and met farm managers and workers to get on the ground feedback.

The farmers told them the risks that impact them, which enabled Skyline to develop a product to match their needs. It’s not just the premiums that are defined up front, but the specific parameters that will lead to a payout. If there’s too much or too little rain, they know how much they’ll get, and they know the payment will be fast. The triggers also include temperature and humidity.

For different types of crops and regions, the triggers are not the same. They could create a product for tea, a product for cardamon, pomegranates and so on.

By working with the tea association, Skyline avoids the costs of selling direct. It’s a win-win for the tea association as they get some compensation plus it serves an important need for their members.

A matter of trust

Jones commented that there’s a lack of trust when it comes to banks and insurers. There are concerns that “when they put a claim in, its challenged. So we’re trying to change all that. Also, people trust technology companies generally.” While Facebook’s recent challenges might dent that confidence, as Jones put it “people have a lot more trust in a technology than in an insurance company.”

And that trust extends to blockchain. Everyone has access to the same weather information. What’s on the blockchain can’t be tampered with or changed. To ensure the weather information is independent and trusted, Skyline partnered with IBM to use their weather data. Hence, when a customer signs a policy, they agree to use that data source. So the farmer’s personal rain measurements are irrelevant.

What about if a farmer pours buckets of water over a rain gauge or takes a lighter to a temperature sensor? When a sensor deviates from others nearby that will register as an anomaly and be reported.

Not an agricultural insurer

Jones and Sabatié emphasized that Skyline is not an agricultural insurer. They’re also developing a renewable energy product. There’s already plenty of insurance available to cover wind and solar equipment. Instead, they’re insuring for loss of income. In the case of wind farms, if winds are too strong, then the windmills have to be switched off because it’s too dangerous. So persistent high or low winds impact income.

Skyline targets the finance companies for insurance distribution because they want to be sure the wind farm owners have enough income to pay back the loans. So it’s insuring the finance of the project and its like a guarantee on the return on a farm.

Whats next for Skyline Partners

So far they’ve created a prototype app for the tea farm insurance with their blockchain based on Hyperledger Fabric. It’s a permissioned network with appropriate access given to policyholders, brokers, insurers, and reinsurers.

There’s no plan for an ICO. Instead, the startup is in the middle of a seed funding round. Once that’s done they can hire a team with the aim of launching the tea weather insurance product by the middle of next year.

The company aims to be a Managing General Agent (MGA) both with Lloyds as well as other insurers. As an MGA they can design products, but pass on the risk to insurance carriers and reinsurers. They don’t need to have a large capital base, and the compliance costs are relatively low.

Sabatié commented: “With the rise of IoT sensors and data captured everywhere, our business model around data and parametric insurance and blockchain is going to emerge. We believe we will have access to products that are not even thought of at the moment.”

The business partners don’t seem short of creative ideas. It’s still very early days for Skyline, but with their combined skills and experience, the future looks bright.

If you’re interested in learning more about Blockchain and Insurance, Hanson Wade is running a conference in Philadelphia in November. For a 10% ticket discount quote code 9702LDGIN10. We’ve found Hanson Wade events have strong speakers, hardly any sponsor promotional content, and provide excellent networking opportunities.