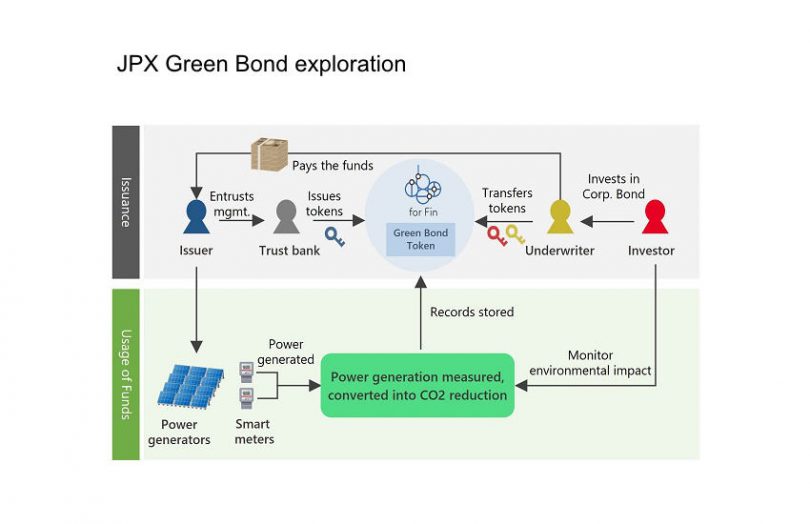

Yesterday Japanese stock exchange operator JPX announced it will explore using blockchain green bonds as part of its goal of becoming carbon neutral by 2024 by switching to 100% renewable energy. It’s partnering with blockchain company BOOSTRY which has its iBet security token issuance platform, which initially targets the debt markets. Nomura and Nomura Research Institute founded BOOSTRY, and SBI is an investor.

JPX is exploring green bonds to fund investment in renewable energy generation such as solar panels or biomass power generation.

While JPX is just at the exploration stage, it sees multiple advantages in using blockchain for a green solution. One benefit is to use the technology to automatically track and transparently share data about the amount of energy generated from the solar or biomass investment. It might also explore a variable interest rate depending on whether the sustainability objectives have been reached. And finally, blockchains act as an ownership registry, making it easy to track the amount of green investments by companies.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.