Yesterday KPMG unveiled Chain Fusion, a solution to enable financial service companies and fintech to aggregate blockchain based and traditional data for digital assets to run analytics. The solution is intended to deal with the whole array of assets from Bitcoin and stable coins to central bank digital currencies (CBDC).

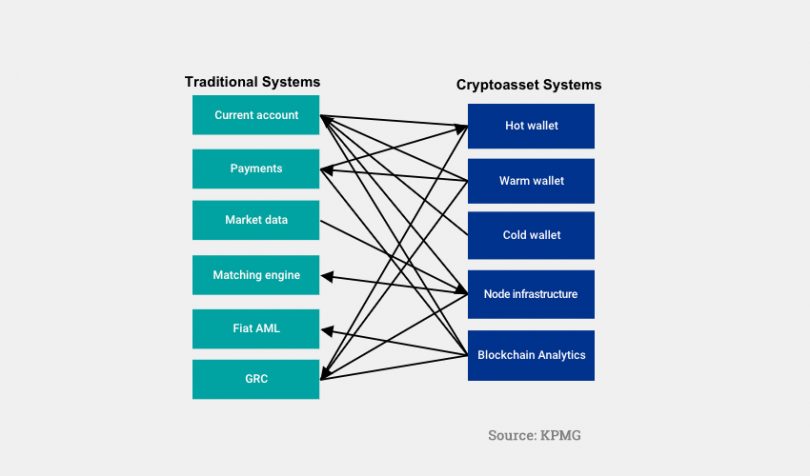

The visual above gives a good idea of the gulf in architecture between traditional and digital asset systems. Hence amalgamating the data from both types of platforms is a non trivial matter.

The solution uses a structured data model for digital assets or cryptoassets so that analytics can be run for typical purposes such as business analysis, risk assessment and compliance, including anti money laundering (AML).

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.