Today Mastercard unveiled a crypto identity solution, the Mastercard Crypto Credential. The first use case is for cross border transactions between the U.S., Latin America and the Caribbean that require a considerable amount of compliance.

Stepping back, there’s no compliance if one sends a p2p payment using cryptocurrency. The primary crypto transactions that require compliance are anything involving a cryptocurrency exchange.

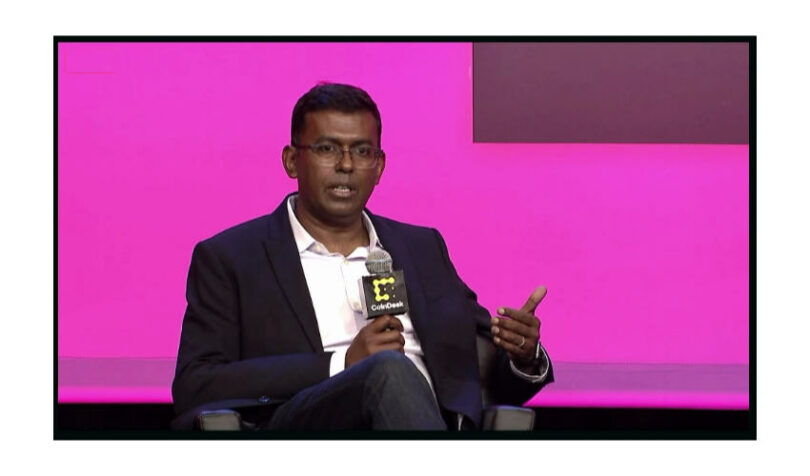

At the Consensus event today, Mastercard’s Raj Dhamodharan discussed the potential for regulated institutions and governments to start using public blockchain. “All of them are looking for an identity approach to which wallets they can interact with, what kind of activities they can do in a compliant manner,” he said.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.