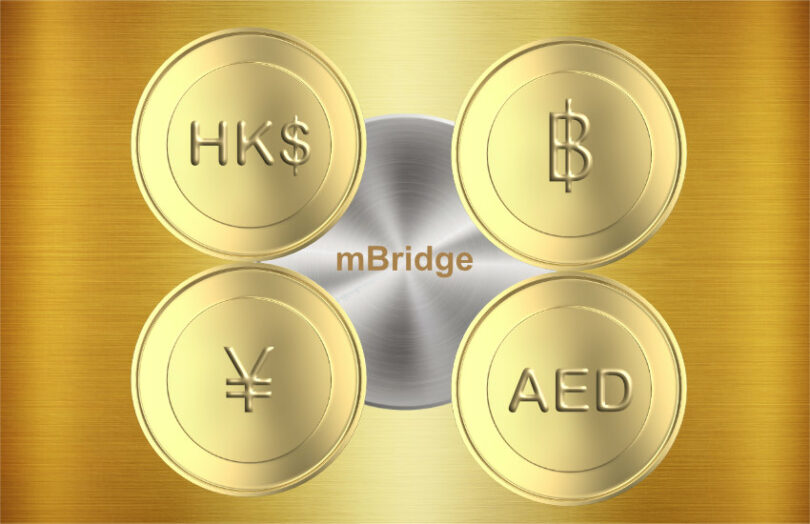

There’s been much talk about the coming fragmentation of payments. A key driver is geopolitics and the use of Swift for sanctions. Countries that fear they could be next have started looking for alternatives. Technology isn’t necessarily the driver of fragmentation but is an enabler. Some envisage the cross border CBDC project mBridge as one of the platforms that could break Swift’s stranglehold over cross border payments. Launching in mid-2024 with a minimum viable product, mBridge involves the Bank for International Settlements (BIS) and the central banks of China, Hong Kong, Thailand and the UAE.

We explore why mBridge’s use of digital currency could help it gain traction. The short answer is it could eventually reduce bank costs for cross border payments.

Greater international use of the RMB has been a Chinese government goal for some time. But the currency’s usage has not matched the growth of its economy. Arguably, there are many reasons, which are not the topic of this piece.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.