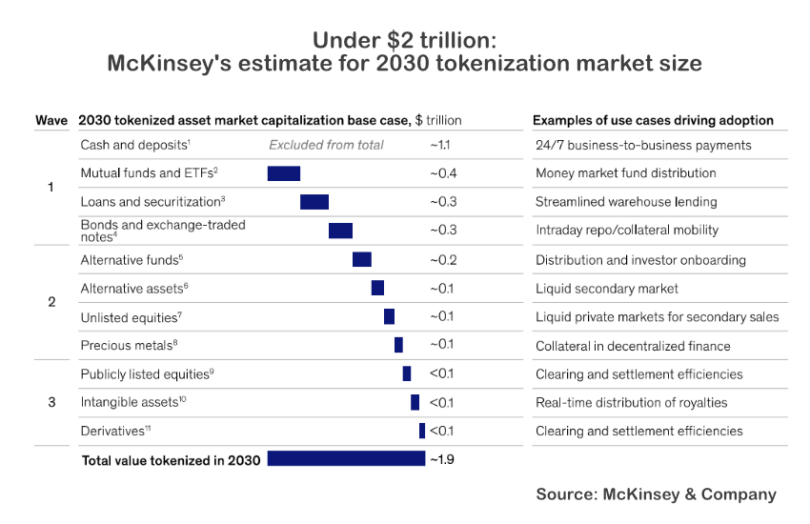

Two years ago Boston Consulting Group (BCG) estimated that the market size for tokenized assets would reach $16 trillion by 2030. However, the market has failed to reach the growth rate predicted for 2024. Yesterday, McKinsey & Co published its predictions that it would be less than $2 trillion by 2030, with a range of $1 to $4 trillion. This compares with estimates last year from Bernstein of $5 trillion by 2028 and the same figure from Citi by 2030.

Unlike BCG, McKinsey refrained from making annual predictions, a strategy that may mean we forget their projections by the time 2030 comes around. However, the consultants did share the reasoning behind their numbers. They pointed out that in the first five years of inception, financial innovations such as credit cards and ETFs showed annual growth rates of around 100%. Subsequently, growth slowed to 50% before declining further. Hence, McKinsey used a compound annual growth rate of 75 percent.

McKinsey’s paper acknowledges the progress in certain asset classes such as money market funds, loans and securitization, bonds and repos. Hence it sees these as part of the first wave of tokenization which is likely to reach significant size.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.