Mercuria, one of the world’s largest energy and commodities traders, has ambitions to transform how the sector operates. To achieve its goal, it is setting up Mercuria Technology Ventures (MTV) to target investments in blockchain and AI companies. Together with other investors, it expects the funds available to reach $100 million in the near term.

The privately-owned firm had a gross turnover of $122 billion in 2018. Mercuria was founded in 2004 by Marco Dunand and Daniel Jaeggi, two ex-Goldman Sachs traders who are still significant shareholders. After acquiring the physical commodities unit of JP Morgan Chase in 2014, two years later, state-owned Chem China made a strategic investment.

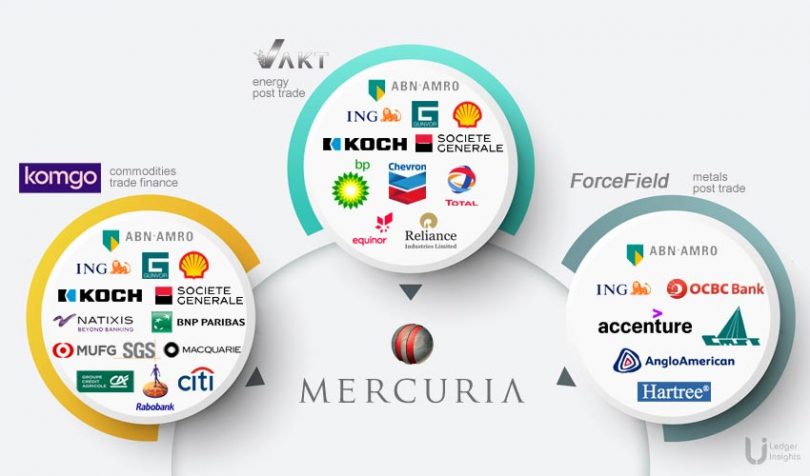

In the last two years, Mercuria has invested in three major consortia-style enterprise blockchain ventures. The first investment was in

VAKT, the platform that enables the oil sector to function more efficiently by focusing on post-trade automation and reconciliation. VAKT already handles more than 90% of North Sea oil trades and is expanding into other energy markets.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.

Image Copyright: Composite Ledger Insights, Logos respective rights owners