UK startup Millicent received a grant from UK Research and Innovation to develop a digital finance infrastructure. Earlier this month, it completed the first trials of its Full-Reserve Digital Currency (FRDC) as a demonstration within a sandbox environment. The FRDC is a distributed ledger (DLT) based currency, similar to a stablecoin, where the funds that underpin the digital currency are held in a ring-fenced central bank account. This addresses many of the concerns that stablecoins face about the quality and liquidity of their backing.

Millicent is squarely focused on the retail sector for person-to-person payments. And as its name hints, co-founder and CEO Stella Dyer has financial inclusion as a key target for the company. While Dyer might be Harvard educated and have a track record at Goldman Sachs and Morgan Stanley, she moved to the UK as a childhood refugee from Nigeria’s civil war. She is acutely aware that high payment costs are borne by those that can least afford them.

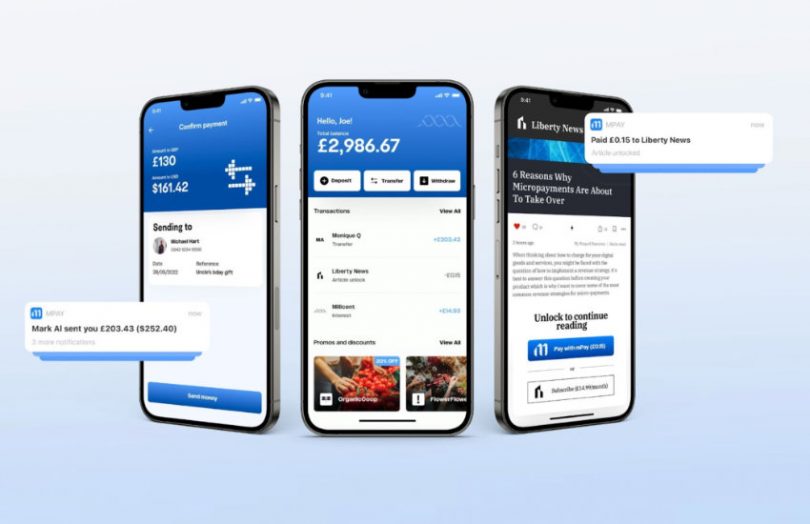

One of the first tests involved a micropayment of 15 pence for a paywalled newspaper article and a one-pound digital tip to a street musician using a QR code. All were settled almost instantly and with nominal fees.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.