UK startup Millicent received a grant from UK Research and Innovation to develop a digital finance infrastructure. Earlier this month, it completed the first trials of its Full-Reserve Digital Currency (FRDC) as a demonstration within a sandbox environment. The FRDC is a distributed ledger (DLT) based currency, similar to a stablecoin, where the funds that underpin the digital currency are held in a ring-fenced central bank account. This addresses many of the concerns that stablecoins face about the quality and liquidity of their backing.

Millicent is squarely focused on the retail sector for person-to-person payments. And as its name hints, co-founder and CEO Stella Dyer has financial inclusion as a key target for the company. While Dyer might be Harvard educated and have a track record at Goldman Sachs and Morgan Stanley, she moved to the UK as a childhood refugee from Nigeria’s civil war. She is acutely aware that high payment costs are borne by those that can least afford them.

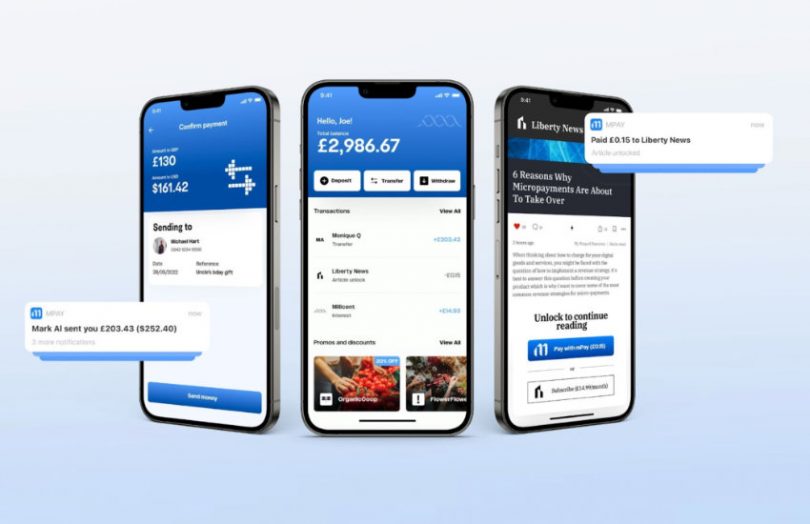

One of the first tests involved a micropayment of 15 pence for a paywalled newspaper article and a one-pound digital tip to a street musician using a QR code. All were settled almost instantly and with nominal fees.

Why the central bank account matters

Holding all the digital currency’s backing funds in a central bank account radically reduces the risk of a run on the token. That’s because it can always meet any demand to convert the digital currency back to conventional money. And it can do it quickly.

Rumors around how the Tether stablecoin has invested its funds have done the rounds for years. Even Circle’s USDC, regarded as higher quality, has been called into question in some quarters. USDC is considered safer because its funds are now invested entirely in U.S. government Treasuries and commercial bank accounts. God forbid it experienced a run. It would have to sell Treasury securities in bulk, creating a short delay. Large volume sales of Treasuries could potentially impact Treasury markets and the broader economy if a digital currency is widely used.

In the Millicent case, there’s no delay and no immediate impact on Treasury markets. The funds in the central bank account are private funds rather than owned by the central bank, and hence it fits the definition of a synthetic central bank digital currency (CBDC).

Millicent believes the synthetic CBDC terminology can be confusing and prefers to call it an FRDC to distinguish it from a CBDC and the typical stablecoin. A valid point, although it adds to the jargon in the sector.

Another UK synthetic CBDC project, Fnality, is also not keen on the synthetic CBDC label. Sixteen financial institutions have backed Fnality, which is planning to launch its solution in October. Fnality’s offering is for interbank or wholesale transactions, whereas Millicent is retail focused.

How it works

Minting the Milicent FRDC works by transferring money from a UK commercial bank using the Faster Payment System. The money is held in a ring-fenced central bank account and the digital currency was then used to try a variety of payment and settlement scenarios.

In terms of technology, the demo used a public permissioned blockchain using Cosmos’ Tendermint consensus.

There’s more on that below, where Co-founder and President Kene Ezeji-Okoye responded to our queries by email.

Q&A with Kene Ezeji-Okoye

Can you share more re the legal aspects?

We have a partnership agreement with a regulated financial institution that will hold our customer funds in a segregated, ring-fenced account at the central bank. As part of our agreement, we aren’t able to share the name of this partner until our network goes live.

Funds held on behalf of our clients will meet current UK e-money regulations, and therefore be bankruptcy remote, with full liquid reserves on hand for each token issued. In the (unlikely) event of Millicent’s insolvency, or that of our partner institution, all clients would still have a claim to their funds.

Does the privacy aspect different from other stablecoins?

Currently, our network provides the same anonymity as other blockchains like Ethereum, etc.

However, the end-user application that we are launching soon provides a strong way to balance on-chain user privacy, with the risk-based AML approach favored by regulators and used by fintechs and conventional financial institutions.

We are also investigating solutions incorporating ZK proofs and viewing keys for some point in the future.

Which public permissioned blockchain?

We weren’t able to find the perfect blockchain for our needs, so we decided to build a custom network using the Cosmos SDK. The SDK provides a fantastic base with which we were able to create an ideal digital finance infrastructure, including sub 2 second settlement times and native interoperability with a host of other blockchains. The upgradable nature of the framework also allows for a large degree of flexibility in terms of future-proofing, or widening the scope of applications.

One of the most important decisions behind choosing to build a custom chain was the ability to influence the governance structure. There aren’t really any public-permissioned frameworks in the wild, although it’s the best way to ensure democratic community governance — where everyone gets a seat at the table — can be balanced with user safety and regulatory compliance.

How will cross chain transactions work?

With Cosmos’ InterBlockchain Communication (IBC) modules, the Millicent Network will be natively interoperable with the “internet of blockchains” in the Cosmos Ecosystem. There are also already solid bridge frameworks, e.g. Gravity Bridge, that allow cross-chain transactions to Ethereum and other chains, as well as projects developing IBC modules for asset and data interoperability with permissioned blockchains like Hyperledger Fabric, Corda and Quorum all of which have featured in CBDC pilots around the world.

It’s highly likely that we will also release native versions of FRDC directly on Ethereum, as well as a variety of EVM and non-EVM compatible chains in the near future.

Do you have a view on how CBDCs might work where a CBDC is not on blockchain, yet provides utility for blockchain payments?

The “platform” model of CBDCs, as outlined by the Bank of England, is a very workable design for a two-tiered structure where a central bank would not provide CBDC to the public, but rather to regulated Payment Interface Providers (PIPs). These PIPs would, in turn, disseminate CBDC to the general public—much as one can withdraw central bank money (cash) from an ATM provided by their local commercial bank.

The interface between the central bank and the PIPs need not be built on a blockchain, it could operate via simple API, but some PIPs could choose to build their retail networks on a blockchain as Millicent has done.

What’s next?

Next up is a lot of testing in advance of a public launch. We’re very excited about putting the true benefits of digital currencies in the hands of as many people as possible — and already have a waitlist in the tens of thousands for our consumer app — but financial services is a delicate field, and we need to make sure that everything is perfect before rolling out.

As my mother used to say “More haste, less speed.” So we expect to launch publicly in late Q4 this year.

Update: changed the technology to Tendermint consensus. A previous prototype used a DAG like IOTA, Hedera.