Today Mitsui & Co Digital Asset Management (MDM) announced a collaboration with JFR card, a store card, allowing consumers to invest directly in tokenized real estate. The card is part of J Front Retailing which owns the Daimaru Matsuzakaya Department Stores as well as online retail outlets.

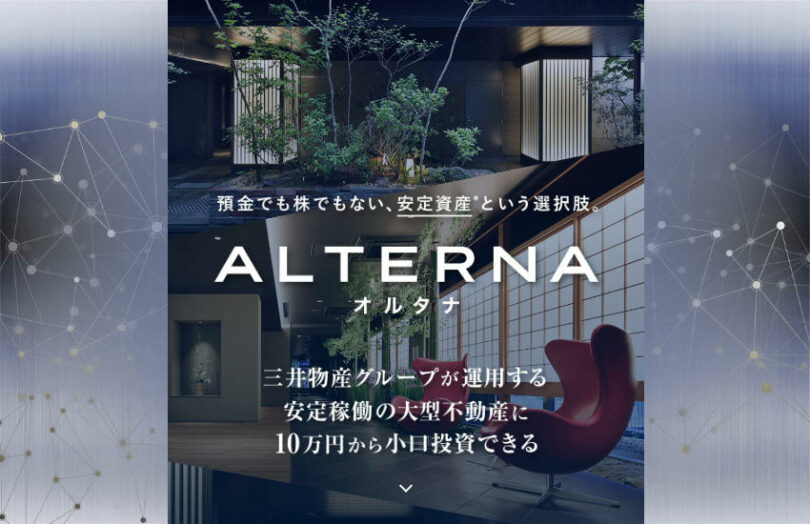

In May, MDM launched Alterna, a real estate tokenization offering, with each issuance as a digital security for a specific building. That’s not the interesting part. As an asset manager, it sells digital securities directly to retail investors. This is the sort of experiment we’re likely to see from asset managers in other jurisdictions in the future. That’s providing legislation supports it.

With JFR Card, consumers will be able to invest on a drip basis.

While these digital securities sidestep typical securities brokers, they don’t entirely avoid intermediaries. After all, here JFR card is acting as an intermediary. And in June, MDM signed online-only Sony Bank as another introducer.

However, there is a fundamental difference between a broker and an introducer.

Digital securities: broker versus introducer

With a broker as an intermediary, the client relationship is with the broker and the asset manager is somewhat removed in the background. Every transaction goes through the broker’s books and eventually through to the asset manager. There are likely several other intermediaries including fund distribution platforms, fund administrators, third party transfer agents and custodians. These all incur additional overhead.

In contrast, if the customer is introduced by Sony Bank or JFT card, they are only introducers. The customer interacts directly with MDM’s Alterna mobile app. In other words, the asset manager MDM has a direct relationship with its investors. Sure, they’ll pay some sort of introducer fee. But apart from that, the investment is only recorded in one set of books – the blockchain and books of MDM/Alterna.

That saves a huge amount of administrative costs. In turn, this allows MDM to set low investment minimums – Yen 100,000 ($670). And it should result in better returns for investors. Plus, over time, MDM gets to know its investors. While it’s not something MDM has stated, one can imagine that knowledge might support personalized investment offers in the future.

Meanwhile, Mitsui & Co Digital Asset Management is a joint venture between Mitsui & Co (53%) and LayerX (36%), with minority interests from SMBC Nikko Securities, Sumitomo Mitsui Trust Bank and JA Mitsui Leasing. However, Mitsui is also an investor in LayerX.